Metals form an important part of global commodities. Precious metals serve beyond their traditional usage and as a store of value or as a hedge against inflation. Industrial metals like Zinc are important gauges to determine the global economic activities.

In this FxWirePro commodities watch, we are to present our readers the performance of the various commodities, categorically classified, which are keys to understand the broader global economy. For example, copper is considered as a barometer of global economic activity or gold is considered as a safe haven.

After being the best performer last year after energy, this year it is struggling to make gains. Nevertheless, it remains a much better performer compared to the energy pack.

In this part, we present the metals, both precious and industrial.

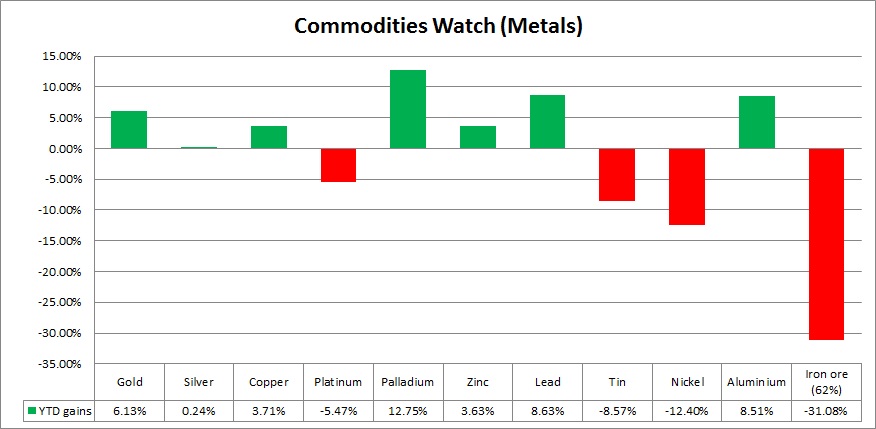

- The best performer in the metal pack has been Palladium which rose 12.7 percent, followed by Lead (8.6 percent), Aluminium (8.5 percent), Gold (6.1 percent), Copper (3.7 percent), and Zinc (3.6 percent).

- Silver is up less than a percent.

- The worst performer is Iron ore, which is down 31.1 percent, followed by Nickel (-12.4 percent), Tin (-8.6 percent), and Platinum (-5.5 percent).

In 2016, the metals as a pack were up more than 28 percent but this year they are down just 1.3 percent so far. This pack has declined by 0.6 percent since our last review back in May.

Despite the decline in oil price, metals have been largely successful in holding their grounds.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed