In this Commodities Watch, we present to our readers, the performance of commodities, which in turn decide the wellbeing of many commodity producing and consuming nations. For example, India is a major consumer of oil, so if the price goes higher, it may drag the country’s trade balance as it imports most of its consumption.

There has been a change in tide in the commodities market, which we feel is of utmost importance to keep a tab on. Why?

Historically speaking, a rise in commodity prices has triggered a vicious chain reaction. First, the prices of commodities go up, which in turn triggers a rise in inflation, which again has historically triggered selloffs in bonds, which has not been good for equities sometimes. In a world, where central banks have provided unprecedented stimulus, the rise in inflation is the biggest possible threat.

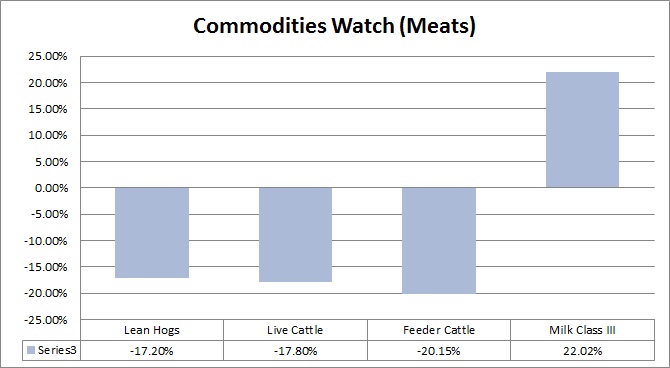

In this article, we evaluate the YTD performance of the meats and products, which are consumer in large parts of the world.

- In this pack, Milk has been the best performer with 22 percent YTD gains.

- The rest of the pack haven’t performed well. The worst performer has been feeder Cattle, which is down by 20.1 percent so far this year, followed by Live Cattle (-17.8 percent), and lean hogs (-17.2 percent).

This group is the worst performer among all the commodities with 8.3 percent YTD loss on an average.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed