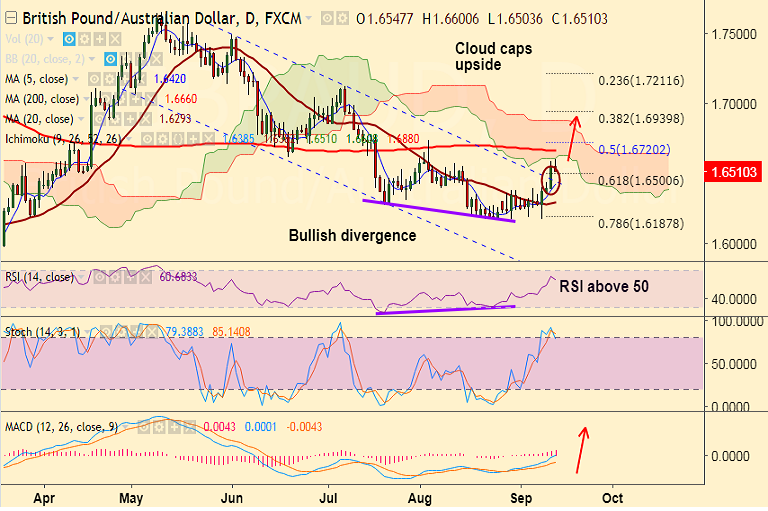

- GBP/AUD broke out of downward sloping channel at 1.6465 on Tuesday's trade.

- The pair is currently struggling to get past stiff resistance by daily cloud at 1.6608.

- Price was rejected at cloud base, the major has slipped lower to currently trade at 1.6497.

- British Pound gained fresh traction after upbeat UK inflation data boosted BoE rate hike expectations on Tuesday.

- However, the British Pound is now losing some of its initial shine after mixed results from the UK’s labour market report.

- UK unemployment rate ticked lower to 4.3% bettering estimates on the three months ended in July, while the claimant count change dropped by 2.8K.

- Technical studies support upside in the pair. We notice bullish divergence on daily charts. Scope for test of 200-DMA at 1.6662 on break above daily cloud.

- Weakness likely on retrace into channel. Break below channel top at 1.6450 to see drop till 20-DMA.

Support levels - 1.6450 (channel top), 1.6418 (5-DMA), 1.6350 (Sept 11 low)

Resistance levels - 1.6608 (daily cloud), 1.6660 (200-DMA), 1.67, 1.6720 (50% Fib retrace of 1.5789 to 1.7650 rally)

Recommendation: Stay long for target (200-DMA at 1.6660).

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest