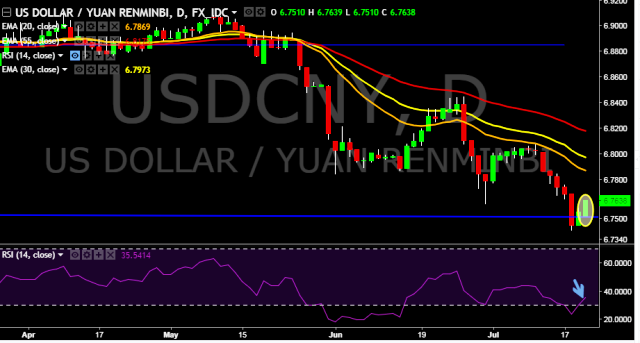

- USD/CNY is currently trading around 6.7623 marks.

- It made intraday high at 6.7638 and low at 6.7510 levels.

- Intraday bias remains bullish till the time pair holds key support at 6.7449 mark.

- A sustained close above 6.7550 marks will test key resistances at 6.7689, 6.7757, 6.7842, 6.8009, 6.8070, 6.8250, 6.8440, 6.8526, 6.8671, 6.8882, 6.8942, 6.9010 marks 6.9080 marks respectively.

- Alternatively, a daily close below 6.7550 will drag the parity down towards key supports at 6.7449, 6.7403, 6.7222 and 6.7118 marks respectively.

- PBOC sets yuan mid-point at 6.7464/ dlr vs last close 6.7526.

- Fitch on China says tightening is likely to become more targeted as authorities try to limit impact on economic growth.

- Fitch on China says more unified regulatory approach would be positive for long-term stability of China's financial system and economy.

We prefer to take long position in USD/CNY around 6.7580, stop loss at 6.7449 and target of 6.7842.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest