China reported trade surplus a USD 23.9 billion in March of 2017, compared to a USD 25.2 billion surplus a year earlier and above market expectations of a USD 10 billion surplus. Exports surged by 16.4 pct YoY, following a 1.3 pct drop in February while markets anticipated a 3.2 pct growth. Imports rose 20.3 pct, after jumping 38.1 pct in the prior month and above consensus of an 18 pct rise.

On the back of this Chinese data, bulls of NZDUSD have managed to bounce back to the current 0.70 after testing supports at 0.6905 levels.

The pair in medium term perspective: Potential for higher to the 0.7150-0.7300 area during the month ahead, as USD longs are paired. Further out, the Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD down towards 0.6800.

Weaker dairy prices plus the RBNZ’s emphatic reminders it is on hold for a long time should also weigh. In New Zealand, business confidence dipped and credit conditions stayed tight.

Option Trade Recommendations:

Moreover, all these factors are discounted in FX options market. You could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM put strikes in 2m tenors.

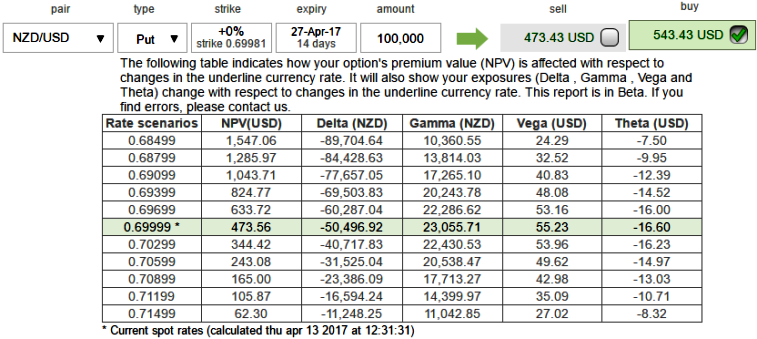

Please note that 2w ATM puts are trading 14.79% above than NPV, whereas, ATM IVs are creeping up at just 9.10%. This disparity could be addressed in below option strategy.

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders, hence, we eye on writing overpriced out of the money put options that likely to reduce hedging costs of long legs.

Well, these positive skews in 2m implied volatilities signify hedging interests in downside risks and the combination of IV 3-6m skews suggests RKO calls on both hedging as well as speculative grounds, the NZDUSD 2-3m skew has been well bid with Fed’s hiking expectations in June meeting and global commodity price turbulence.

To factor in the weakness in this pair as we could see reasonable IVs even in next 1-3m skewness, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

So, here goes the strategy this way, initiate long in 2 lots 1M ATM -0.50 delta puts, long in 2M (1%) OTM -0.35 delta put, and simultaneously short 2W (1%) ITM shorts, the spread is to be executed in the ratio of 3:1with net delta at around -0.70.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes