AUDUSD contained in a 0.7600-0.7700 range. AUDUSD medium term perspectives: Although the pair bounces off the 0.7450, the upside area should be limited to 0.7600.

RBA has limited the downside on AUDUSD during the next few weeks, and it is momentary. But we foresee it would be heading towards 0.74 by year end.

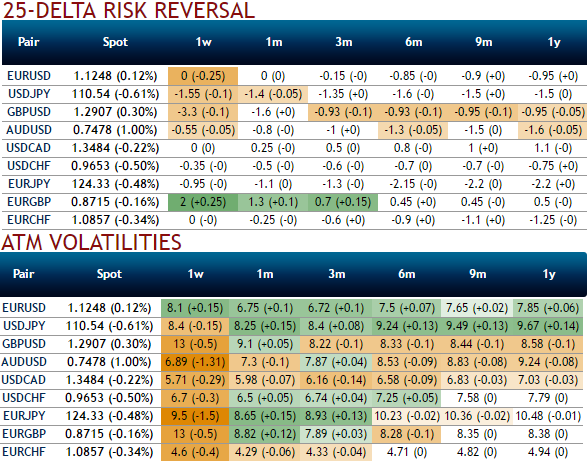

To substantiate the delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels.

OTC hedging arrangements for downside risks seems intact, you could make this out from the above nutshell evidencing risk reversals, while IVs are feeble which is in tandem with the above mentioned underlying forecasts and its rationale.

Please be informed that the nutshell showing negative risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Option Trade Recommendation:

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms