The Fed unsurprisingly delivered the sixth rate hike in the current cycle. The target range for the federal funds rate is now at 1.50%-1.75%. Considering the recent hawkish turn in Fed communications, markets were more interested in the economic projections of meeting participants. And, indeed, policymakers now see stronger growth and a lower unemployment rate. For 2018, the dot plot still indicates three rate hikes, but the rate path for next year is now somewhat steeper.

The robust US dollar depreciation realized since mid-December seems to have been stopped for now and most recently the US currency was able to regain some lost ground again. There is only one currency in the G10 universe that did considerably well since early February and that is the Japanese yen. JPY’s outperformance for the past two weeks has been remarkable, JPY appreciated to the highest level in 6 months in nominal weighted terms.

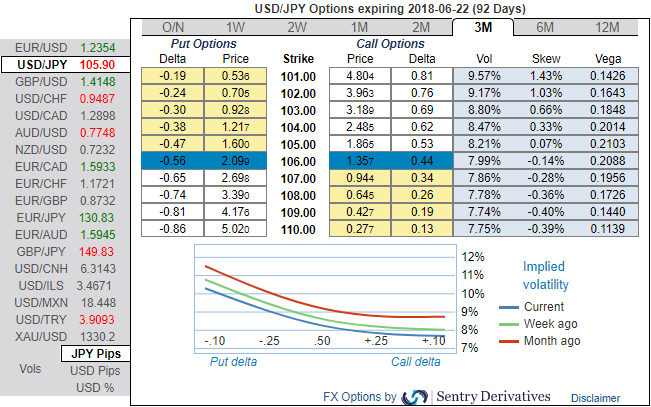

If at all USDJPY is projected to slide towards 101 on following driving forces, the below options strategy is advocated on hedging grounds.

The driving forces that likely to lead further USDJPY weakness:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) The expectations for more hawkish than expected personnel change of the BoJ heighten.

Options Strategy:

The implied volatility of ATM contracts of USDJPY is trading back towards 8% and 8.4% for 2w/2m tenors respectively, as the positively skewed IVs of 3m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders. Despite a positive shift in risk reversal numbers, the hedging sentiment for the bearish risks appears to be intact. On the flip side, it is wise to utilize abrupt rallies amid shrinking vols in the below-stated options strategy.

If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 2w/2m put ratio back spread strikes 107.771/105.515 (2 lots), (vanilla: 0.75%, spot ref: 105.858). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of OTM put.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -39 (which is bearish), while hourly JPY spot index was at -71 (mildly bearish) while articulating at 06:58 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge