The RBNZ is scheduled for their monetary policy this week. The kiwis central bank cut 50 bps in its August meeting and had said that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point.

They have demonstrated its willingness to take bold steps, which means markets are likely to remain dovishly positioned for some time. As discussed in our recent posts, we now think the odds favor the further RBNZ rate cut the OCR to a new low of 0.75% in November. Combined with easing from other central banks, that should push NZ swap rates to fresh record lows.

Hence, we reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 67 levels by year-end.

The global risks are reckoned to play less conducive for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. The pair is forecasted to depreciate below 67 levels by year-end.

While the NZDJPY trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDJPY shorts via options in the past, suitable options strategy is designed favoring bearish side.

OTC Updates, Trade and Hedging Recommendations:

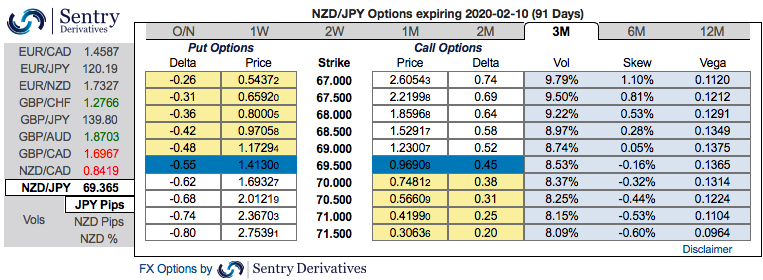

3m IV skews are right indications for NZD that have clearly been indicating bearish risks. The major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

The positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 67.00 levels (refer above nutshells evidencing IV skews).

Hence, initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit (spot reference: 69.399 levels).

Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Alternatively, shorts in the mid-month futures have already been advocated with a view of arresting the downside risks. We wish to uphold the same short hedge strategy of mid-month tenor that was advocated in our previous post.

One can also buy tunnel options spreads with upper strikes at 69.420 and lower strikes at 69.323 levels on the trading grounds. Courtesy: Sentrix

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures