In the end, it makes no difference to the Bank of Canada (BoC) what today’s labor market report for March is going to be – always assuming of course that it doesn’t produce an extreme result, which we do not expect.

In March, the BoC had already made it clear that is going to take a break for now. It maintained its generally restrictive approach, but the uncertainty regarding future rate increases had risen according to the BoC.

The slowdown in the economy in Q4 had been stronger than expected. The effects of the mixed data signals on the growth and inflation outlook would have to be examined first.

As a result, the key rate (currently 1.75%) would remain under the neutral level of 2.5%-3.5% for now, according to the BoC. So unless the data improves significantly and quickly, which is not expected, the BoC will keep everything on hold.

In its new Monetary Policy Report at the end of April, it is likely to revise its growth outlook to the downside and probably also assume a neutral approach. As a result, CAD is likely to have little upside potential against USD this month.

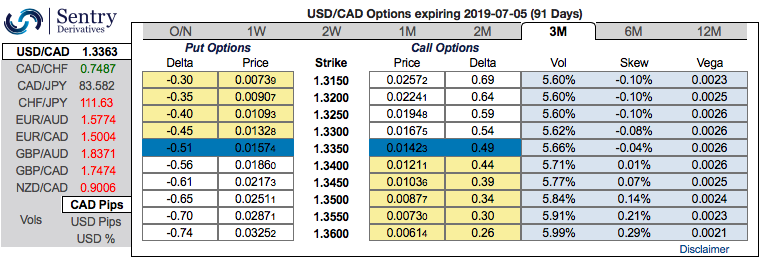

The measures of implied CAD volatility are dipping and the cost of hedging against CAD strength in the near term is sizing higher.

Please be noted that the IV skews of CAD cross tenors have been indicating downside risks. The positively skewed IVs are stretched towards OTM put options, the underlying movement with lower IVs can offer economical OTM option pricing. Courtesy: Commerzbank & Sentrix

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -7 levels (which is neutral but mildly bearish) while articulating at (10:11 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios