The CAD has held relatively steady since Friday’s jobs prints — US NFP +156K (miss), Canada +35.2k (beat)—ahead of today’s BoC Business Outlook Survey which will act as one of the final keys to the puzzle ahead of next week’s rate decision. The BoS, which was carried out between late-Nov (coinciding with the CN rail strike) and early-Dec, will be closely watched by Gov Poloz and company particularly as it relates to investment intentions as the Bank considers the path forward for monetary policy.

At the moment, markets remain unconvinced that the BoC will deploy monetary stimulus in the near future, with cut odds currently sitting at 33% by mid-year.

On the other hand, economists are essentially split between those calling for cuts against those expecting the BoC to remain on hold.

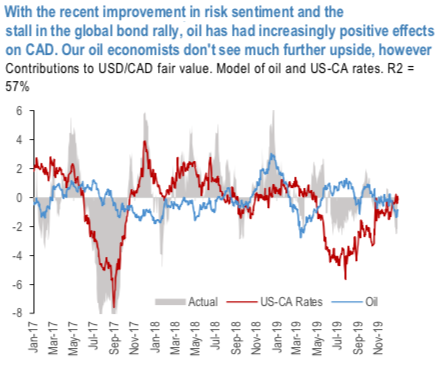

CAD was also relatedly underpinned by considerable gains in oil, which despite round-tripping of the post- Middle East geopolitical flare-up in the past week, is still 10% higher on net over the last three months (consistently, worth about 1.4% lower on USDCAD in JPM’s latest models) (1st chart). This move lower in the pair sets a higher hurdle for our CAD 2020 view, which has been expecting underperformance, including against the dollar, to be front-loaded in the first quarter, even as the overall global FX view had been expecting some broad USD weakness in 1Q.

Despite this recent beta-driven CAD strength, the view for underperformance in 2020 on domestic factor still holds, though may be less front-loaded than originally expected. This view has been predicated on an expected dovish BoC responding to a broadly-weaker economy, potentially forced to ‘catch up’ to other central banks globally, having earlier eschewed rate cuts in 2019, thereby warranting some catch-up CAD weakness.

OTC Updates and Options Strategy:

The positively skewed CADJPY IVs of 6m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 78 levels indicating downside risks in the medium terms (refer 2ndexhibit). While considering the technical chart for the minor uptrend and major downtrend (3rd & 4th exhibits).

Accordingly, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of 1m tenor. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of customized version of options combination and more bearish version of the common straddle.

Huge profits achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move in next 3-months’ time.

Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentry & JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One