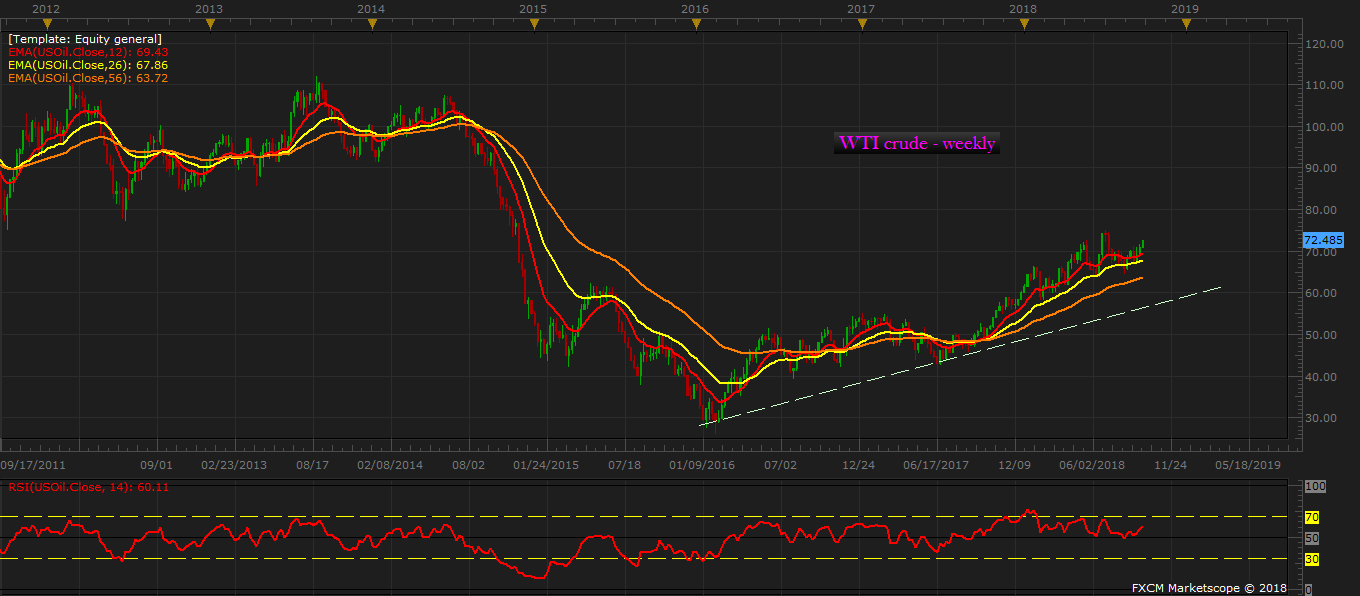

In early July, we suggested that oil price is likely to move lower before longer-term buyers emerge again in the market amid rising supplies, https://www.econotimes.com/FxWirePro-Another-5-percent-decline-in-oil-price-likely-before-buyers-emerge-1402976 we forecasted that WTI would decline to as low as $67 per barrel area.

As the price declined further, in a follow up review, we have extended our WTI price target from $67 area to as low as $52 citing some of the key bearish fundamentals; Middle East truce, weaker demand from China and India due to respective slowdown in the economies, higher production in Saudi Arabia, Russia, Iraq, and UAE. The CoT report also suggested the same. Since February this year, speculators have reduced long positions in light sweet crude to the tune of 200,000 barrels or almost 30 percent of the long positions.

However, the price has consolidated since then and our latest calculations suggest that the bulls are back in WTI and far more energized. Though we have suggested that sellers would remain active unless WTI decisively crosses above $76 per barrel area but it looks like that the area would soon be broken and WTI would head higher to reach as high as $84 per barrels area.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX