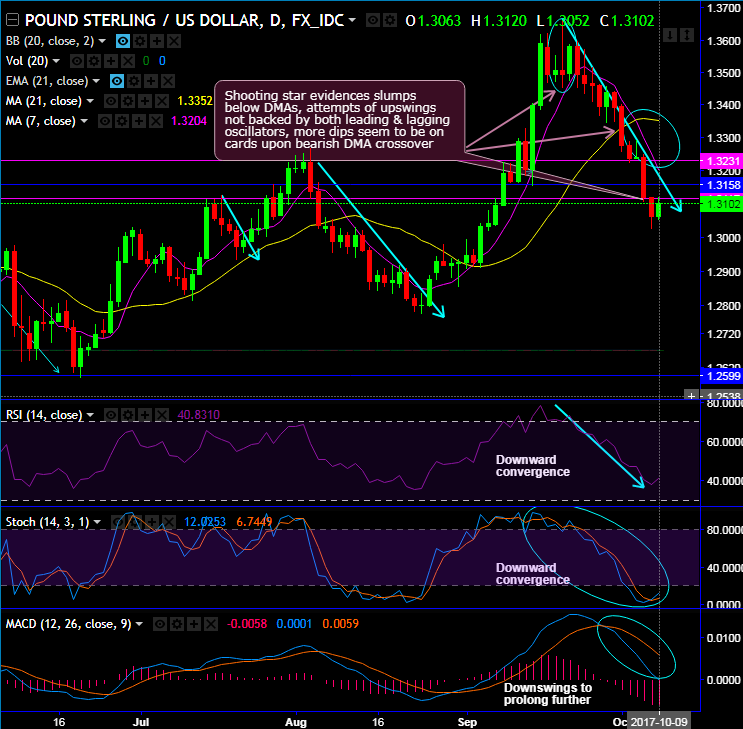

Shooting star has occurred exactly at 1.3495 levels with highs of 1.3658 levels. Consequently, the bearish pattern evidences slumps below DMAs, whereas today’s attempts of upswings are not backed by both leading & lagging oscillators, thus, this is not to be deemed as the better buying opportunity as the more slumps on cards.

We foresee more dips because 7DMA crosses below 21DMA which is the bearish DMA crossover or downtrend confirmation (Refer daily chart).

Both leading oscillators (RSI & stochastic curves) constantly converge southwards along with the price dips that signal strength and momentum in this short-term downtrend.

On a broader perspective, the consolidation phase that has begun since October 2016 is little edgy at channel resistance & 21-EMA levels (Refer monthly chart).

The uptrend on this timeframe is backed by both leading & lagging indicators, more spikes likely upon break out above channel resistance.

More importantly from a vol perspective, sufficient daylight has now opened up between current levels and the previously stable 1.28-1.3650 range in cable such that the potential range of sterling moves and hence realized volatility has expanded, especially if there were to be a broad dollar upturn and/or a reversal/pullback in UK rate pricing.

Even without such a re-assessment, a test and even overshoot of 1.40 on GBPUSD is not out of the question if markets test the BoE's tightening resolve, as is not uncommon during monetary policy inflections.

Hence, we advocate tunnel spreads on an intraday trading basis, alternatively, encourage buying futures contracts of far-month tenors in order to arrest upside risks.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -99 levels (bearish), while hourly USD spot index was at shy above 42 (bullish) at 06:12 GMT, these indices values are also in sync with our above technical rationale. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: