Before we begin with this technical write up, please go through our previous work on this pair where we had advocated short hedges in order to arrest bearish risks about 10 days ago:

Well, they must have fetched us handsome yields by now, rest is history.

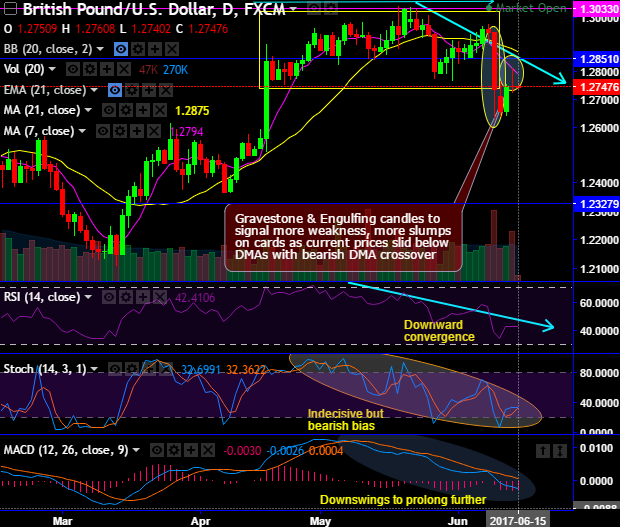

It was when GBP/USD was drifting in a range as shown in the daily charts, bears have managed to form bearing engulfing pattern candle occurred at 1.2740 levels.

Consequently, the prices have slid below DMAs.

Ever since then the bulls swings are restrained below 7DMA, the current prices are well below DMAs.

Yesterday, although bulls have attempted to bounce back but again restrained below 7DMAs, as a result, you could trace out a gravestone doji pattern candle at 1.2750 levels.

Both leading oscillators seem to be in bears’ favor, RSI constantly evidences downward convergence to signal the strength in bearish rallies. While stochastic curves have been slightly indecisive but certainly not in bulls favor.

On the other hand, lagging oscillators are also in sync with the same bearish stance offered by the leading indicators. MACD indicates the price slumps to prolong further, while 7DMA has crossed below 21DMA which is again a bearish signal.

On the broader perspectives, the consolidation phase turns into bearish again, the major trend restrained below 21-EMA, interim rallies not backed decisively by both leading & lagging indicators.

Both leading as well as lagging indicators on this timeframes have been indecisive but seems to be in bearish favor.

Well, overall, the minor trend is weaker for sure, while traces of signals of longs for major trend.

While the FxWirePro currency strength index for the dollar after FOMC announced rates hikes by 25 bps, has been extremely weaker despite relinquishing its 2 days of gains (-74 highly bearish), while GBP has been mildly bullish by flashing +29 for the day eyeing on some sort of cushion ahead of today’s BoE bank rates and UK retail sales data.

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

Trade tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads for the day which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 1.2794 and lower strikes at 1.2658 levels.