The Czech National Bank held its two-week repo rate at a record low of 0.05 pct, to keep its benchmark rate on hold today but the CB sends out a more dovish signal as widely expected.

The discount rate and the Lombard rate were also left unchanged at 0.05 pct and 0.25 pct, respectively.

In April, the central bank decided to discontinue the use of the exchange rate as an additional instrument for easing the monetary conditions returned to the conventional monetary policy regime, in which interest rates are the main instrument. Policymakers said that koruna exchange rate may thus fluctuate in either direction depending on demand and supply.

CNB ended its koruna cap in April, it did so amidst accelerating inflation, which prompted the bank to announce that it would proceed to normalize monetary policy, including raising rates. But since then, policymakers have hesitated to follow up, in fact questioning the need for early rate hikes; last week Governor Jiri Rusnok stated that the koruna's appreciation over the past month means that CNB's first rate hike could be delayed.

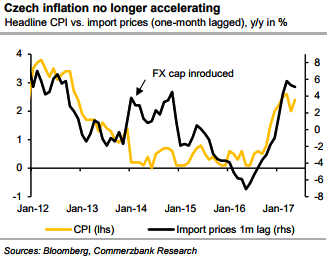

And this change of guidance is being prompted, in our view, by fading inflation momentum in the euro zone, which is also making the ECB cautious about letting monetary conditions tighten from here. In terms of the inflation trend itself, prices accelerated in Q1, but the inflation rate has gone flat for several months now – what is more, the pass-through from imported energy and commodity prices appears to have peaked (refer above chart).

Because of this, more dovish rhetoric today was expected today, highlighting that there is no urgency to raise rates. Policymakers can argue that the exchange rate is anyway tightening monetary conditions and that this should be sufficient to counter wage pressure. We see it unlikely that CNB will embark on a rate hiking cycle when there is uncertainty about ECB policy in the coming months. We see EURCZK drifting lower to around 25.00 by this time next year.

As per JPM’s GBI-EM Model Portfolio: OW TRY and CZK.

Outright trade: Short 27-Nov-17 EURCZK forward.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action