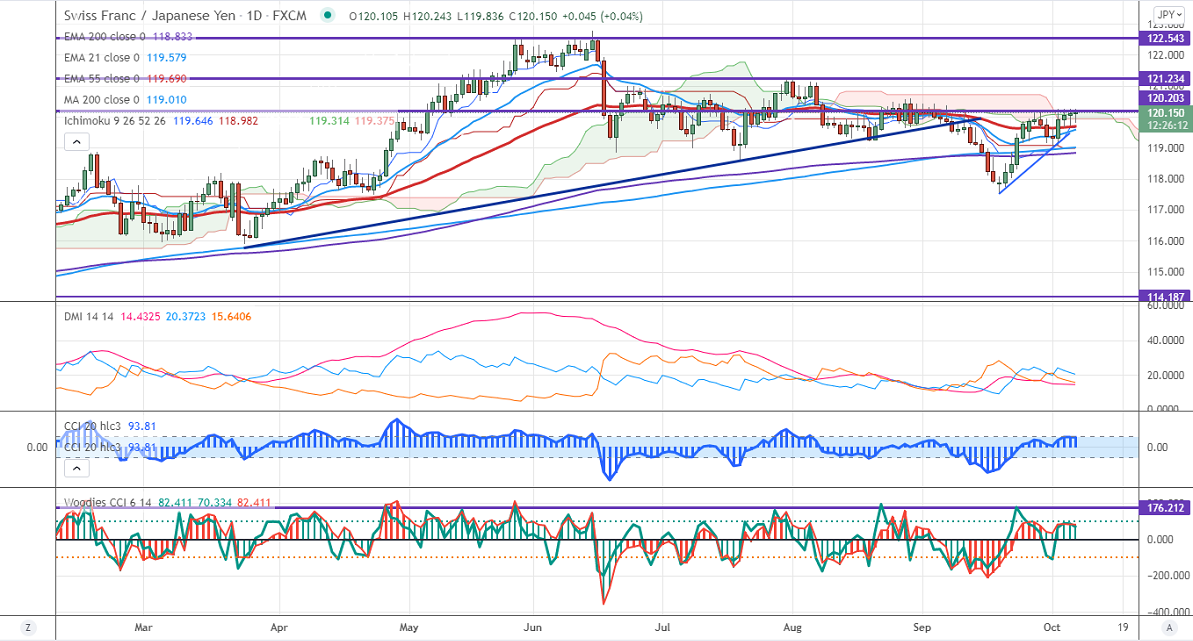

Major Intraday resistance – 120.30

Intraday support- 119.57

CHFJPY is trading between 119.75 and 120.26 for the past two days. It has taken support near 200-H EMA and shown minor pullback. The risk-off mood in global markets as investors are optimistic about the US debt ceiling deal has decreased demand for safe-haven assets like the yen. CHFJPY hits an intraday high of 120.25 and is currently trading around 120.14.

CCI and Woodies CCI analysis-

Both CCI (50) and Woodies CCI are trading above zero lines in the daily chart (bullish trend). In Woodies CCI also six consecutive bars above zero line bullish trend confirmed.

Technically, near-term support is around 119.57 (21-day EMA) and any indicative break below will drag the pair down till 119/118.30/118.

The immediate resistance is at 120.30, any convincing break targets 120.60/121.20/122

It is good to buy on dips around 119.80-85 with SL around 119.30 for the TP of 121.