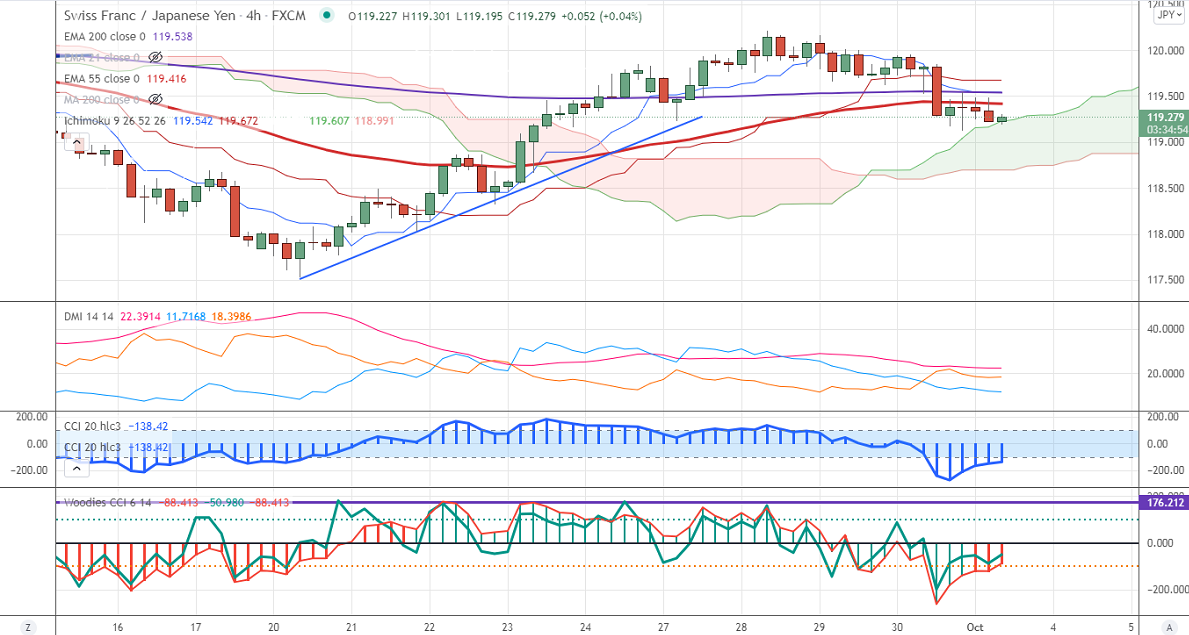

Major Intraday resistance - 119.60

Intraday support- 119

CHFJPY continues to trade lower for third continuous days on a minor pullback in yen. The risk aversion in global markets has increased for safe-haven assets like gold and yen. The Swiss franc has halted its weak trend against the US dollar is preventing the pair from major sell-off. CHFJPY hits an intraday low of 119.98 and is currently trading around 119.976.

CCI and Woodies CCI analysis-

Both CCI (50) and Woodies CCI are trading below zero lines in the 4-hour chart (bearish trend). In Woodies CCI also bearish trend confirmed.

Technically, near-term support is around 119.00 and any indicative break below will drag the pair down till 118.30/118.

The immediate resistance is at 119.60, any convincing break targets 120/120.60/121.

It is good to buy on dips around 119.20-25 with SL around 119 for the TP of 121.