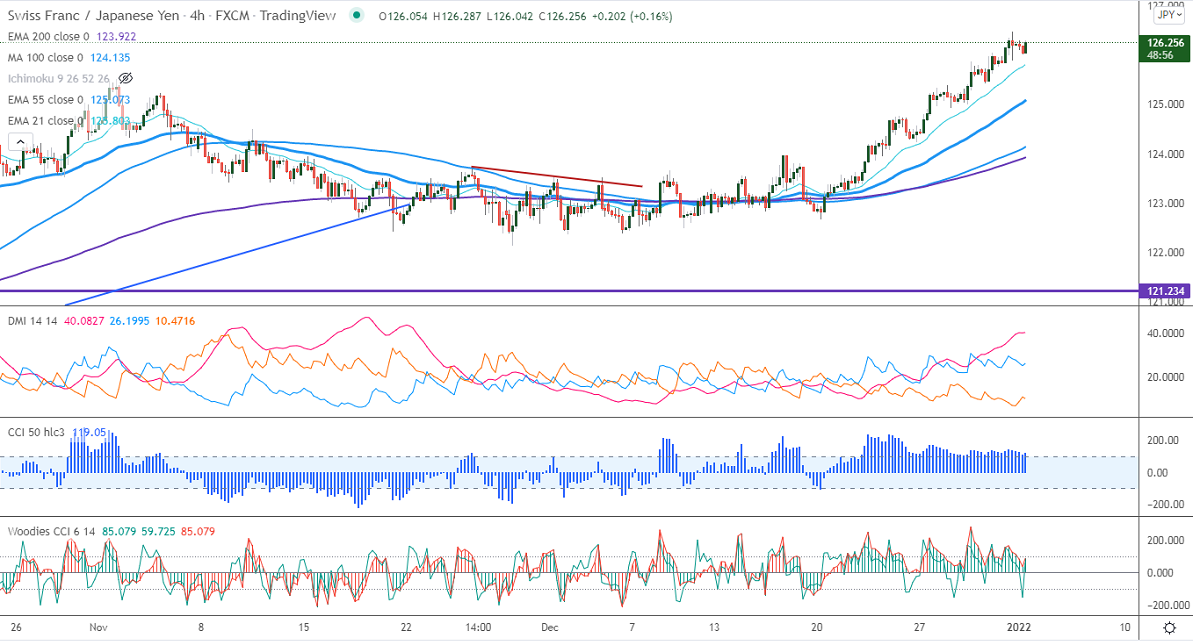

Intraday trend – Bullish

Major intraday resistance – 126.50

The pair hits a multi-year high at 126.47 on board-based yen weakness. The weakness in the Japanese yen is due to upbeat market sentiment and a jump in US treasury yield. USDJPY trades higher for the fifth consecutive week and a breach above 115.50 confirms further bullishness. The USDCHF is consolidated in a narrow range between 0.9102 and 0.91813 for the past three days. CHJPY hits a high of 126.27 and is currently trading around 126.28.

The near-term resistance is around 126.50, any breach above targets 127/127.55. The minor support to be watched is 125.70; the violation below will drag the pair down to 125/123.80

Indicators (4-hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 125.50 with SL around 124.75 for a TP of 127.