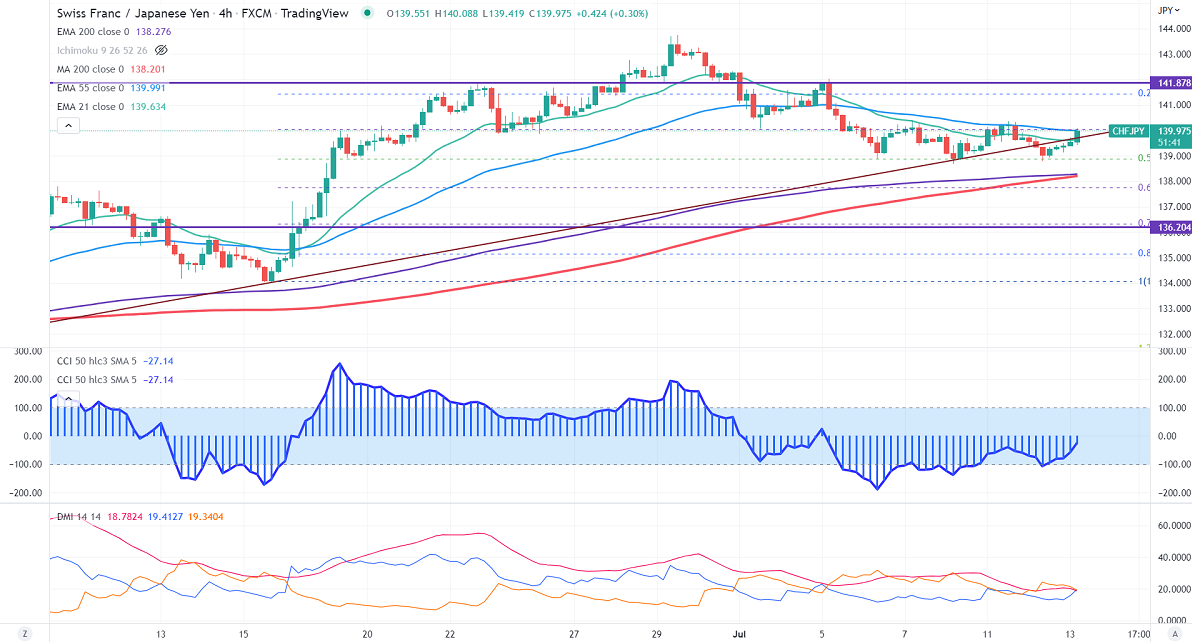

Major Intraday resistance - 140.50

Intraday support- 138

CHFJPY regained above 140 level and hovering around this level. The Japanese yen trade weak on policy divergence between US Fed and BOJ. The minor pullback in the Swiss franc against the US dollar on the board-based US dollar also puts pressure on this pair. Technically, in the 4-hour chart the pair trades above short-term ( 21 and 55 EMA) and the long-term 200- EMA (138.25). CHFJPY hits an intraday high of 140.08 and is currently trading around 140.05.

CCI and Directional movement index analysis-

CCI (50) - Bearish

ADX - Bearish

Technically, near-term support is around 139.40 and any indicative break below will drag the pair down to 138.80/138. The immediate resistance is at 140.50, and any convincing violation above targets 141/141.95.

It is good to buy on dips around 139.80-85 with SL around 139.30 for TP of 142.