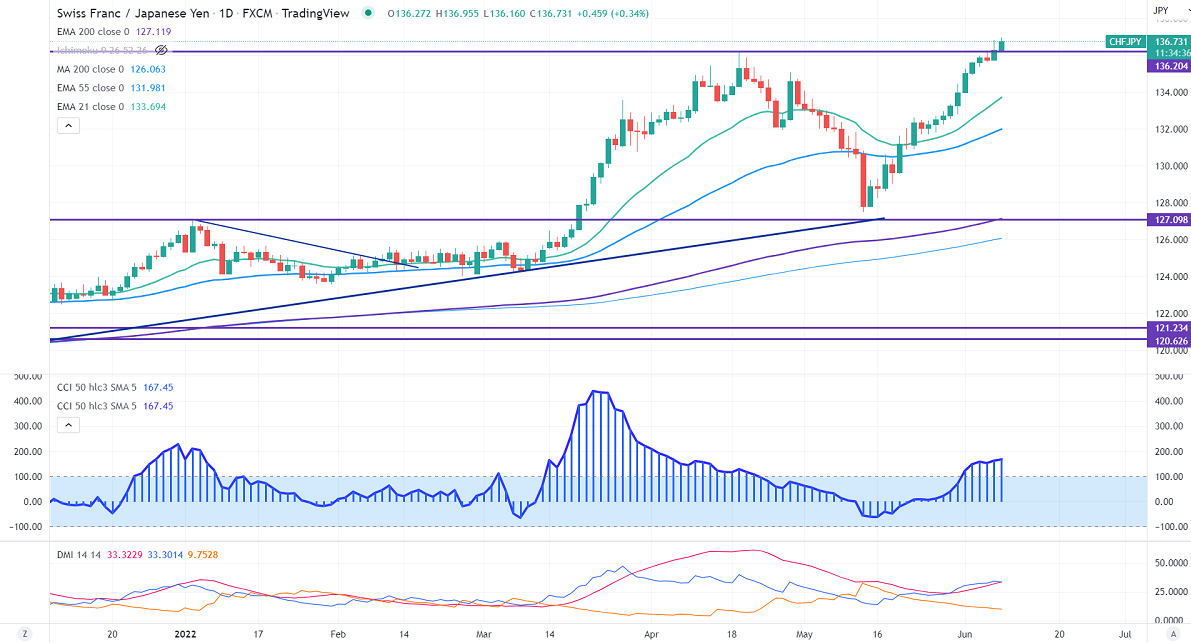

Major Intraday resistance - 137

Intraday support- 136.25

CHFJPY skyrocketed today on the declining Japanese yen. The pair was one of the best performers for the past three weeks and surged more than 800 pips. The surge in US treasury yield and policy divergence between US Fed and BOJ put pressure on Yen. Technically, a break of 136.18 (Apr 19th high) confirms that the downtrend got completed at 127.50, a jump to 1400 is possible. CHFJPY hits an intraday high of 136.95 and is currently trading around 136.607.

CCI and Directional movement index analysis-

Both CCI (50) and ADX show an uptrend in the daily chart. It confirms bullish trend continuation.

Technically, near-term support is around 136.25 and any indicative break below will drag the pair down to 135/134.70/133.40. The immediate resistance is at 137, and any convincing break targets 138/140.

It is good to buy on dips around 136 with SL around 134.70 for TP of 140