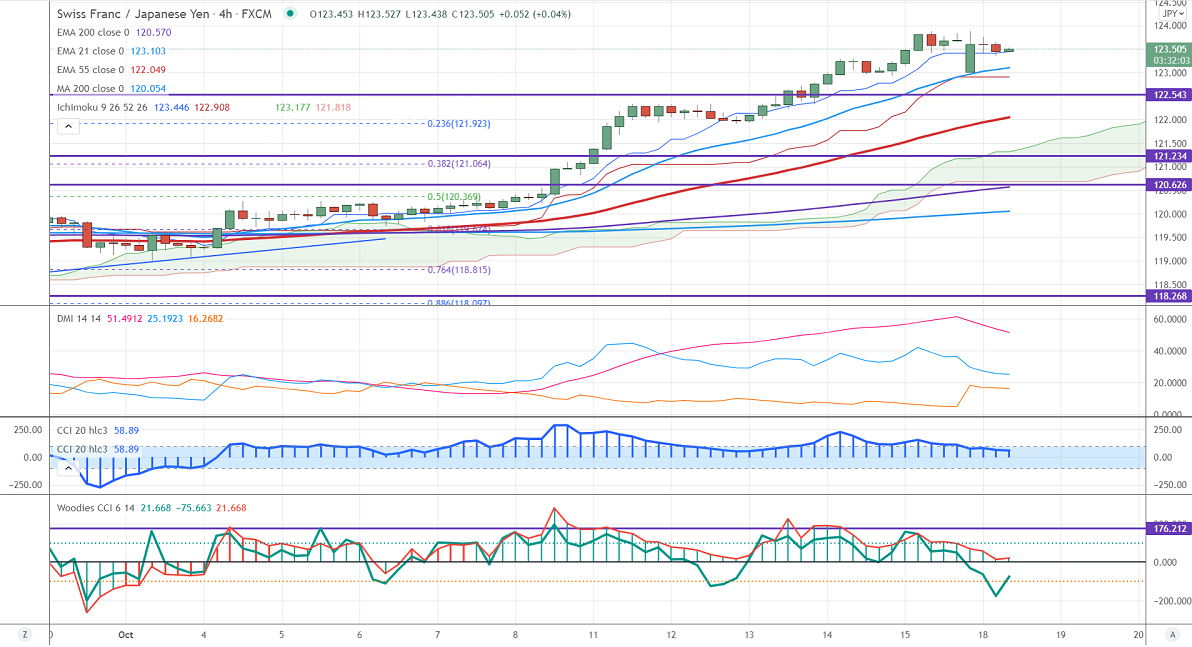

Major Intraday resistance - 123.88

Intraday support- 122.90

CHFJPY is trading slightly lower after hitting a 5-1/2 year high. The pair was one of the best performers this month, jumped more than 450 pips on the weak Japanese Yen. USDJPY hits three years high on surging US treasury yield and upbeat market sentiment. CHFJPY hits an intraday low of 123.40 and is currently trading around 123.507.

CCI and Woodies CCI analysis-

Both CCI (50) and Woodies CCI are trading above zero lines in the 4-hour chart (but below 100 levels) In Woodies CCI also showing a weak bullish trend.

Technically, near-term support is around 122.90 and any indicative break below will drag the pair down till 122.30/122/121.30.

The immediate resistance is at 124, any convincing break targets 125/125.60.

It is good to buy on dips around 123 with SL around 122.30 for the TP of 124.40/125.