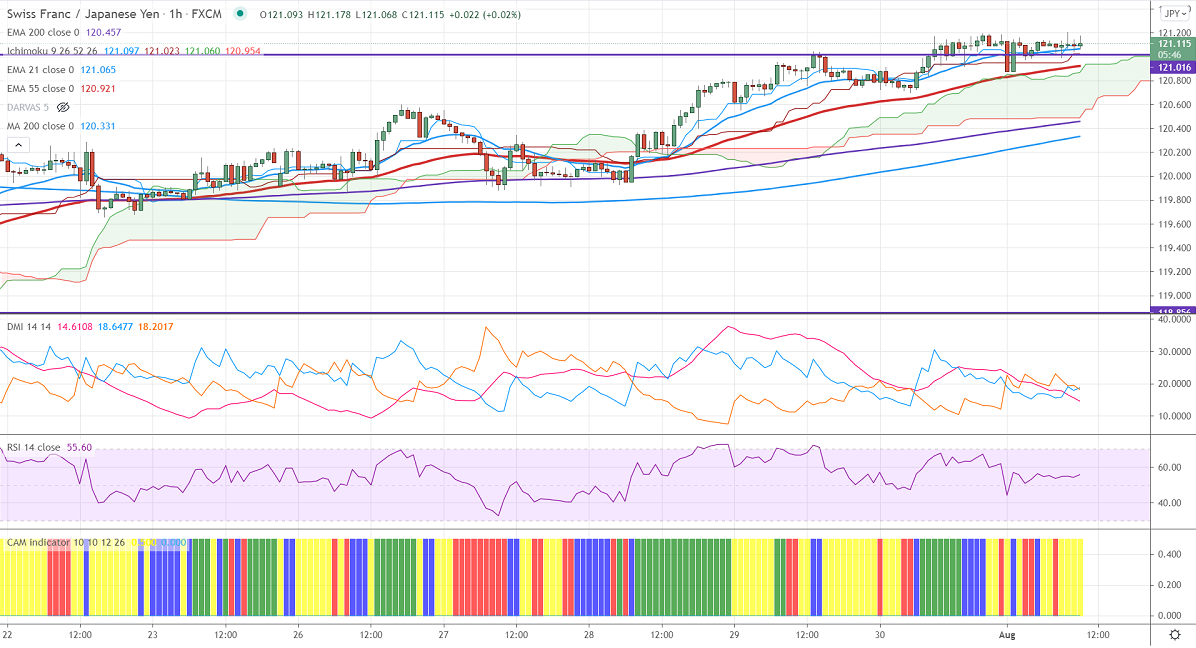

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- 120.95

Kijun-Sen- 120.54

CHFJPY continues to trade higher on board-based Swiss franc buying. The surge in coronavirus across the globe has increased demand for safe-haven assets like the Swiss franc. USDCHF hits a one-month low, any breach below 0.90390 will drag the pair to 0.8925. USDJPY lost more than 50 pips on declining UIS bond yields.CHFJPY hits an intraday high of 121.17 and is currently trading around 121.14.

Technically, near-term support is around 120.80 and any indicative break below will drag the pair down till 120.40/120/119.60.

The immediate resistance is at 121.20, any convincing break targets 122/123.

It is good to buy on dips around 120.75-80 with SL around 120.30 for the TP of 122

Resistance

R1- 121.20

R2- 122

R3-123

Support

S1-119.65

S2-119

S3-118.65