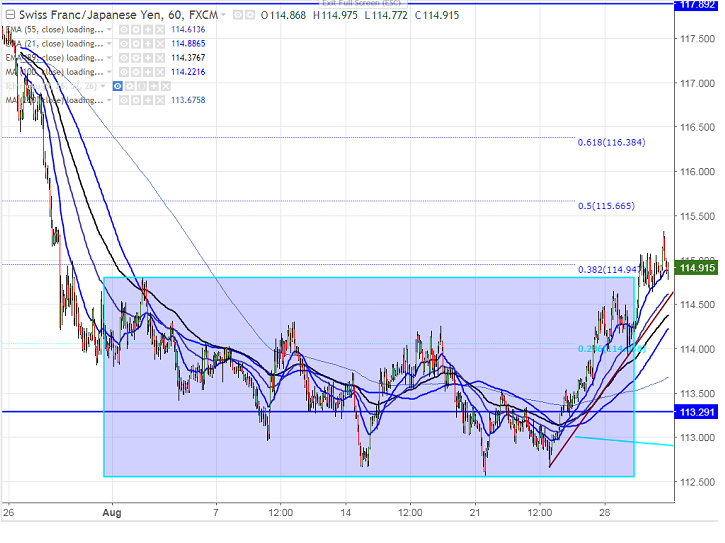

CHFJPY has formed a temporary bottom around 112.65 and started to jump from that level. The pair has broken major resistance 115 and jumped till 115.32 yesterday. The pair is currently trading around 114.93.

The near term support is around 114.55 (trend line joining 112.74 and 113.91) and any break below will drag the pair down till 114.20/113.65 (200- H MA).

On the higher side, near term resistance is around 115.50 and any break above targets 116.38 (61.8% retracement of 118.70 and 112.65)/117.

Short term bearish continuation only below 112.50.

It is good to buy on dips around 114.85-114.90 with SL around 114.40 for the TP of 115.65/116.35.