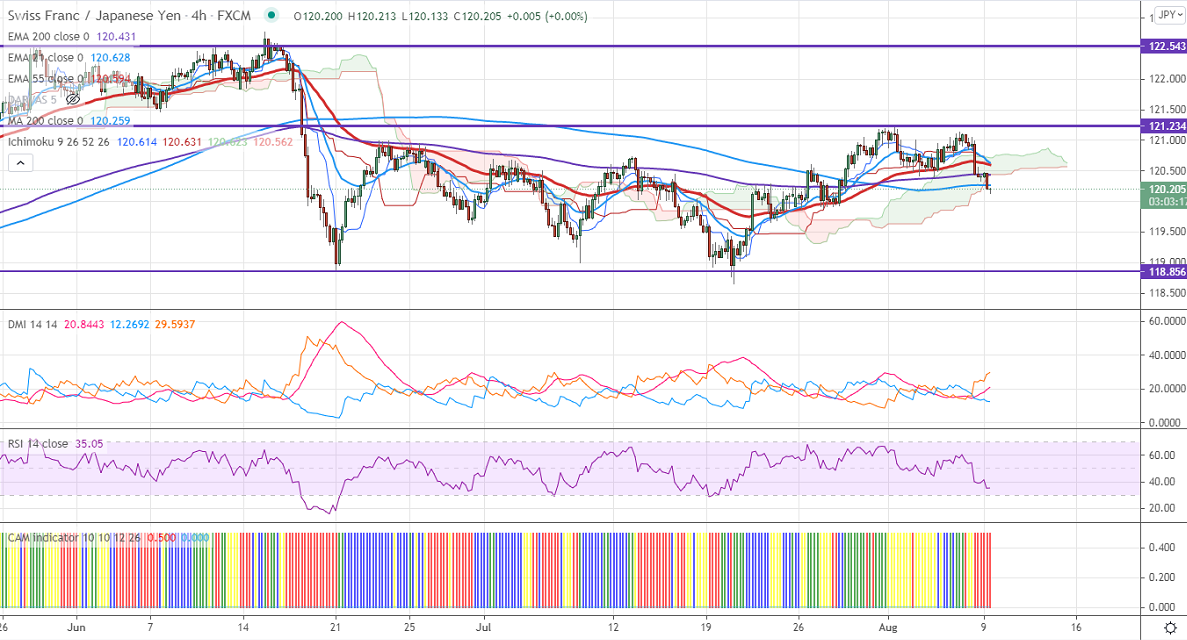

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- 120.65

Kijun-Sen- 120.66

Chart pattern- Adam and Eve Double top

CHFJPY has formed a double top near 121.20 and shown a minor selling. The board-based weakness in Swiss franc against USD after upbeat US jobs data. USDCHF is holding above 0.9150 and hits 2- week high. Any close above 0.91650 confirms further trend continuation. The minor sell-off in the Japanese Yen amid rising US bond yields is preventing further downside of this pair. CHFJPY hits an intraday low of 120.13 and is currently trading around 120.19.

Technically, near-term support is around 119.85 and any indicative break below will drag the pair down till 119/118.65/118.

The immediate resistance is at 120.54, any convincing break targets 121.20/122/123.

It is good to sell on rallies around 120.50-55 with SL around 121 for the TP of 118