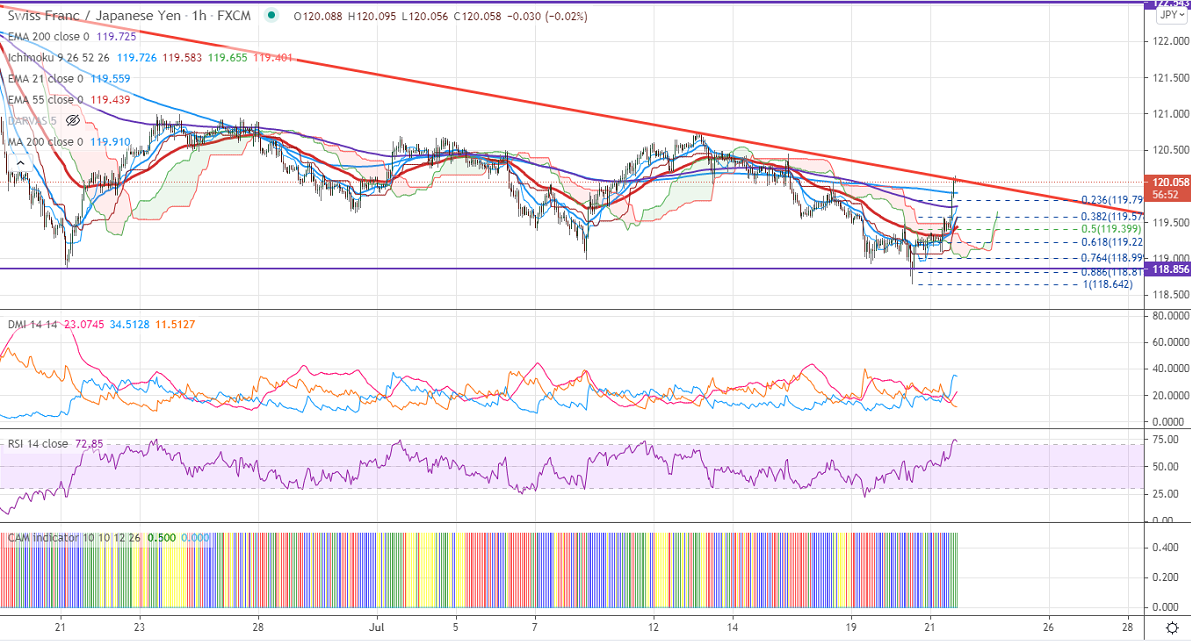

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 119.625

Kijun-Sen- 119.495

CHF/JPY is trading higher for the second consecutive days on minor weakness in the Japanese Yen. The recovery in the US 10-year yield after hitting a five-month low is putting pressure on Yen. USDCHF has once again declined after a minor jump above 0.9200. The pair is struggling to close above 0.9200. Any breach above 0.92750 confirms further bullishness. CHFJPY hits an intraday high of 120.14 and is currently trading around 120.08.

Intraday analysis-

Trend- Bullish

The pair is trading well above 1-hour Tenken-Sen, Kijun-Sen. The near-term resistance is around 120.45. Any close above targets 121/122/123. The immediate support is around 119.70. Any decline below that level will take the pair to 119.39/119/118.85.

Indicator (1-Hour chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to sell on rallies 120.25-30 with SL around 121 for a TP of 118.