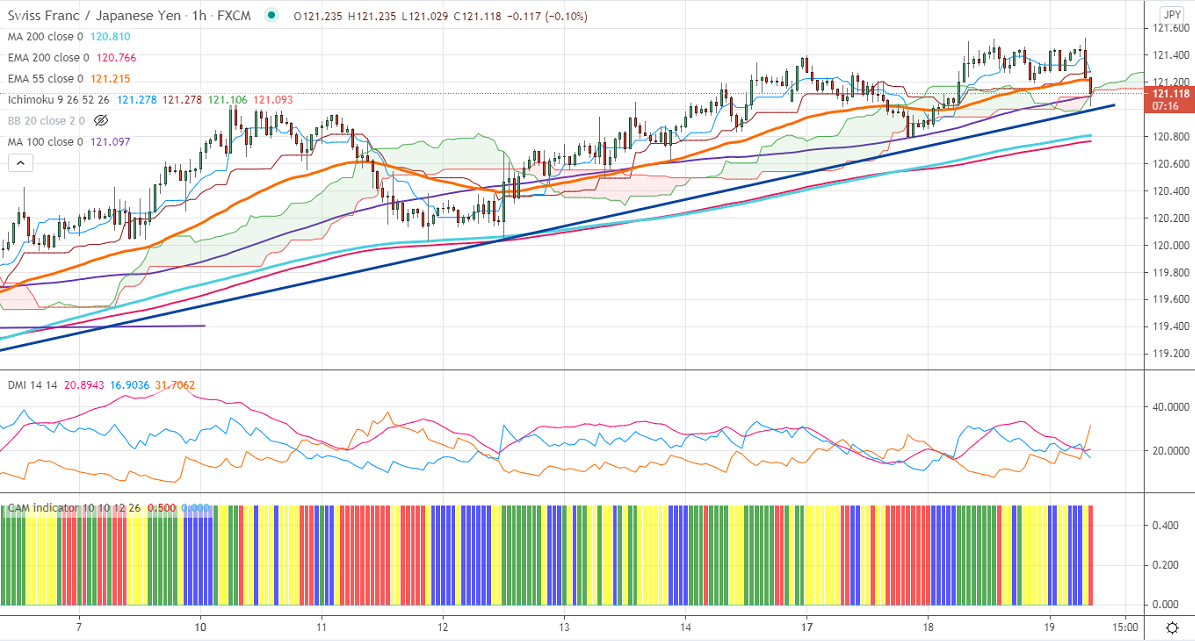

Ichimoku analysis (Hourly chart)

Tenken-Sen- 121.37

Kijun-Sen- 121.27

CHF/JPY has halted its four weeks of the bearish trend and lost more than 40 pips. The minor pullback in the Japanese yen on declining US bond yields puts pressure on this pair at higher levels. USDCHF recovered slightly after a decline till 0.89603. USDJPY formed double bottom near 108.80 and shown a minor pullback. Any breach above 109.12 confirms intraday bullishness. The intraday trend of CHFJPY is bullish as long as support 120.95 holds.

Intraday analysis-

Trend – Bearish

The pair is holding below daily Kijun-Sen, Tenken-Sen, and cloud. On the lower side, near-term support is around 120.95 Any violation below will drag the pair down to 120/119.25/118.60/117.95/116 likely. The immediate resistance is only 121.50. Any violation above that level will take the pair to next level to 122/123/124.45.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index – Bearish

It is good to sell below 120.95 with SL around 121.50 for a TP of 119.25.