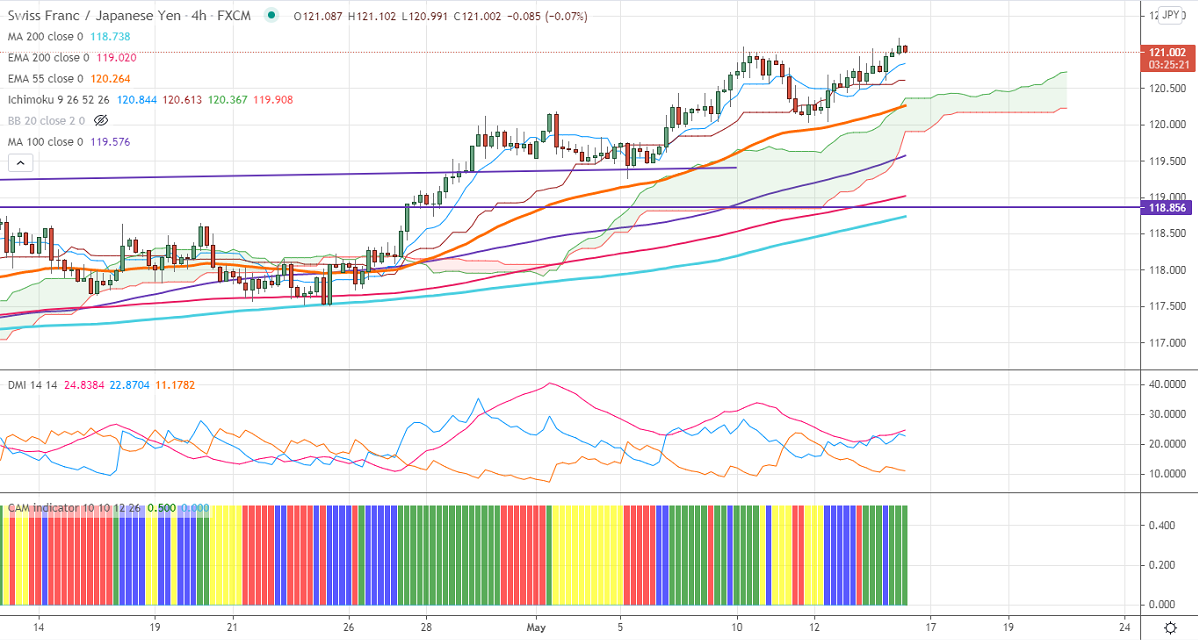

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 120.82

Kijun-Sen- 120.61

CHF/JPY has surged more than 100 pips after taking support near 200-H MA. The broad-based Swiss franc buying is supporting pair at lower levels. USDCHF declined after a minor pullback to 0.90925. A dip to 0.8875 is possible. USDJPYU declined slightly after hitting a monthly high of 109.78. The surge in US bond yields due to pick-up in US inflation is preventing the pair from further sell-off. Minor bullish continuation only above 110. The intraday trend of CHFJPY is bullish as long as support 120 holds.

Intraday analysis-

Trend – Bullish

The pair is holding above 4 H Kijun-Sen, Tenken-Sen, and cloud. On the lower side, near-term support is around 120. Any violation below will drag the pair down to 119.25/118.60/117.95/116 likely. The immediate resistance is only 121.25. Any violation above that level will take the pair to next level to 122/123/124.45.

Indicator (Hourly chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 120.50-55 with SL around 120 for a TP of 122.