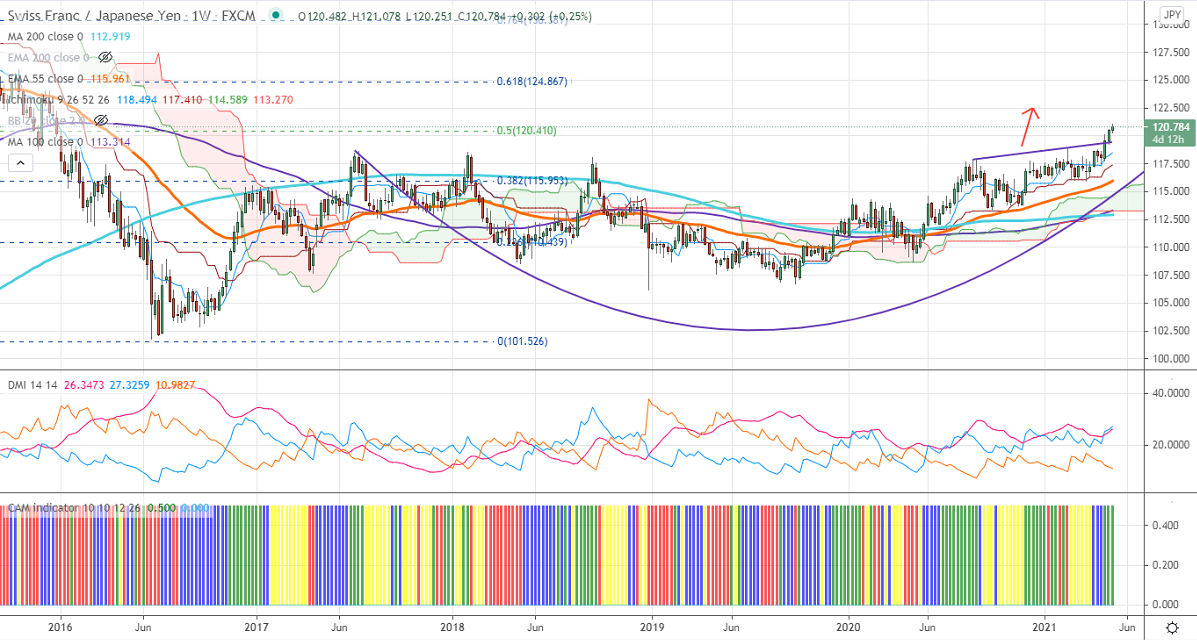

Ichimoku analysis (Daily chart)

Tenken-Sen- 118.26

Kijun-Sen- 117.17

As per our analysis, CHF/JPY is trading on the higher side and jumped to 121.07. The broad-based buying in the Swiss franc is supporting the price at lower levels. USDCHF hits a 2-1/2 month low and holding below 0.9000 levels. The pair has closed below 200- day MA for the second consecutive days and confirms major bearish continuation. A dip to 0.8870/0.8830 is possible. USDJPY paired some of the gains made today despite a jump in US bond yield. The intraday trend of CHFJPY is bullish as long as support 120 holds.

Intraday analysis-

Trend – bullish

The pair is holding above the previous week's high of 120.61. Any violation above 121.25 will take the pair to next level to 122/123/124.45. On the lower side, near-term support is around 120. Any violation below will drag the pair down to 119.25/118.60/117.95/116 likely.

Indicator (Daily chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 120 with SL around 119 for a TP of 122.