Ichimoku analysis (4-Hour chart)

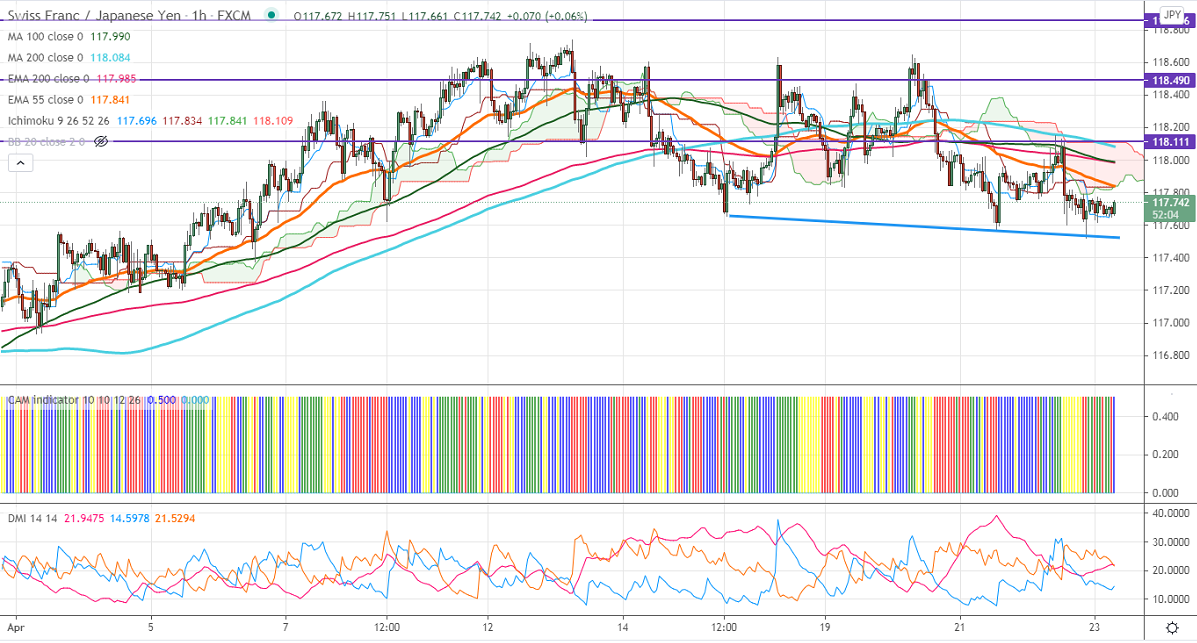

Tenken-Sen- 117.69

Kijun-Sen- 117.83

CHF/JPY continues to trade weak after a minor jump to 118.65. The strength in the Japanese yen due to a decline in US bond yield and an increase in demand for Safe-haven assets. USDJPY is holding below 108 and a dip till 107.20 is possible. The minor weakness in the Swiss franc also dragging the pair. USDCHF has shown a minor pullback from one month low of 0.91289. The Overall trend of CHFJPY is bearish as long as resistance 118.85.

Technical:

The pair's strong support is at 118, any break below confirms minor weakness, and a dip till 117.60/117.20/116.90/116.09 likely. On the higher side, near-term resistance is around 118.85 (Feb 17th high), and any indicative break above targets 119.60/120.40.

Ichimoku Analysis- The pair is trading above 4- hour Kijun-Sen, Tenken-Sen, cloud, and 200-MA.

Indicator (4-Hour chart)

CAM indicator – Slightly Bullish

Directional movement index – Bullish

It is good to sell on rallies around 118 with SL around 118.60 for a TP of 116.20.