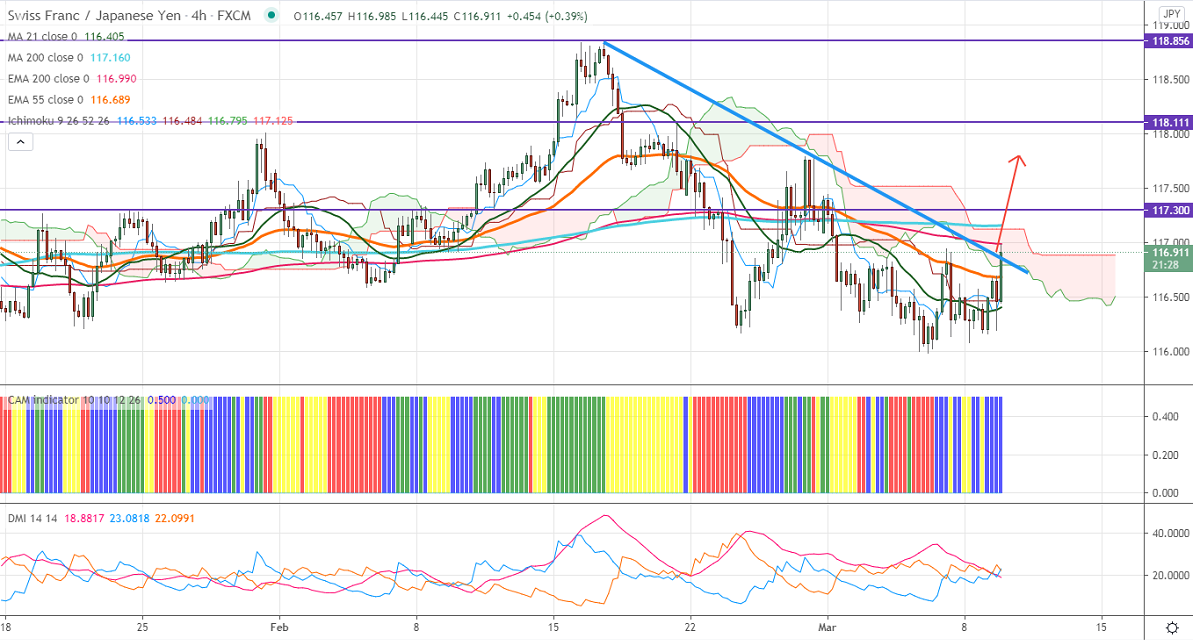

Ichimoku analysis (Daily chart)

Tenken-Sen- 116.385

Kijun-Sen- 116.465

CHF/JPY recovered sharply more than 100 pips after 3 weeks of a bearish trend. The decline of safe-haven demand on upbeat market sentiment is putting pressure on the yen at higher levels. USDJPY hits a 7-month high on surging bond yield. The overall trend of CHFJPY remains bullish as long as resistance 116 holds.

Technical:

The pair's strong support is at 116, any daily close below confirms bearish continuation, a dip till 115.42/115/114.77 is possible. On the higher side, near-term support is around 117.15 (200- 4H MA), and any indicative break above targets 117.76/118/118.85.

Indicator (Daily chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy on dips around 116.60 with SL around 116 for TP of 118.85.