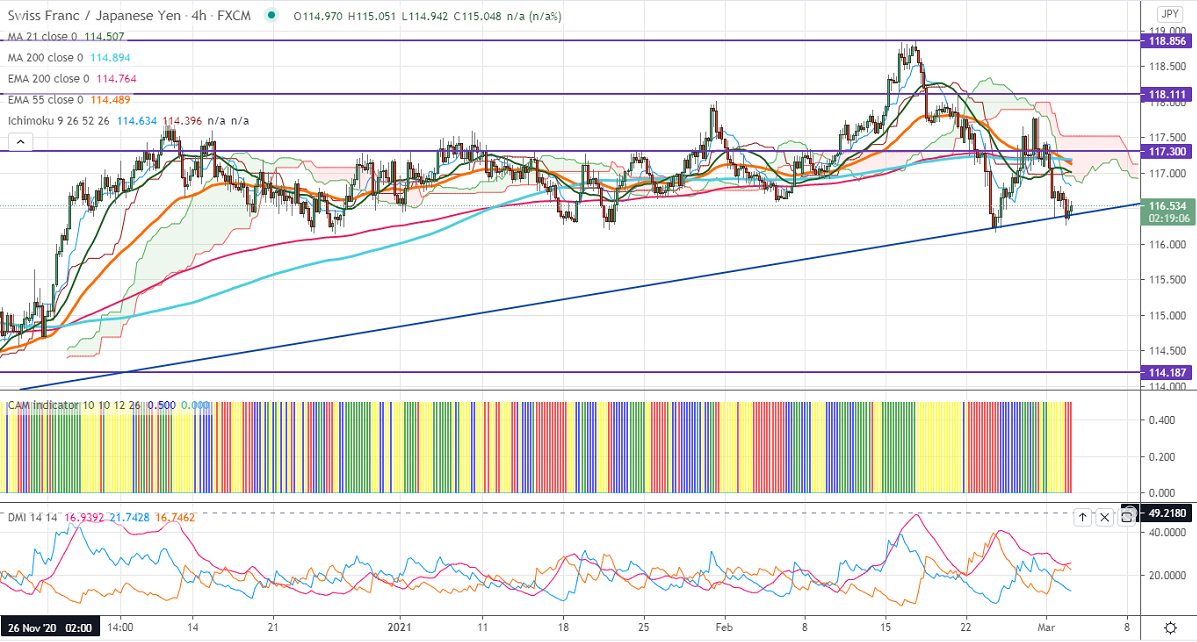

Ichimoku analysis (4-hour chart)

Tenken-Sen- 116.85

Kijun-Sen- 117

As per our analysis, CHF/JPY is trading weak and lost more than 150 pips from minor top 177.78. The decline was mainly due to weakness in the Swiss franc. USDCHF hits a 3-1/2 month high and holding above 0.9150 on broad-based US dollar buying. The intraday trend of CHFJPY remains bearish as long as resistance 117.82 holds.

Technical:

The pair's strong resistance is at 116.80, violation above will take to the next level 117.20/117.82/118. On the lower side, near-term support is around 116.15, and any indicative break below targets 115.35/115.

Indicator (4-hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 116.75-80 with SL around 117.20 for t