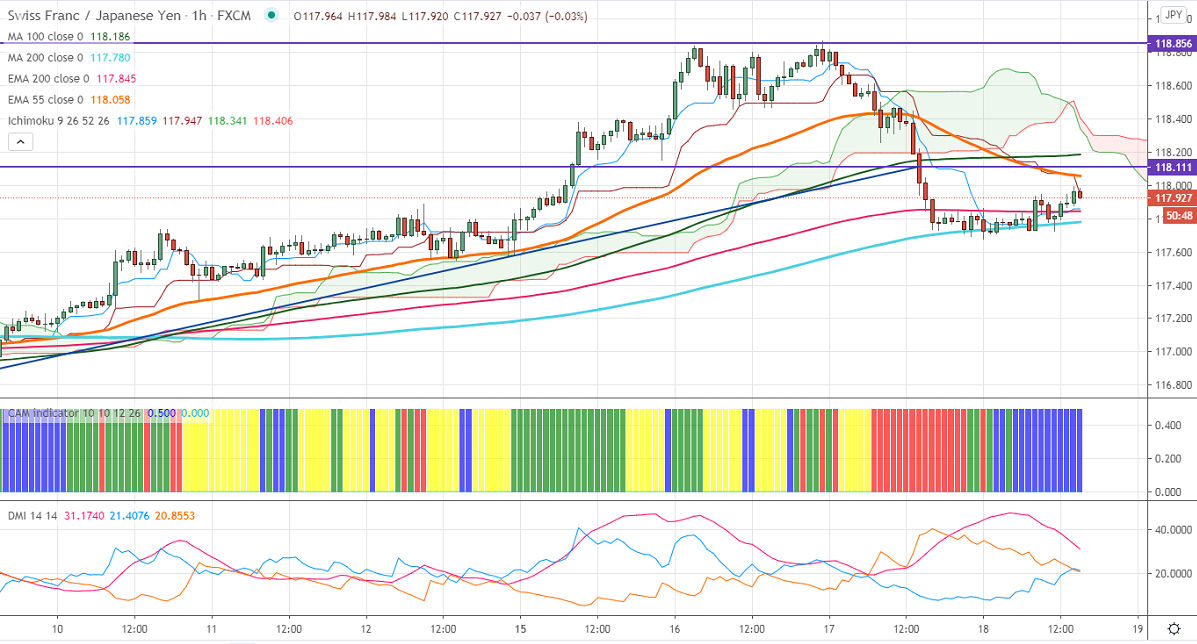

Ichimoku analysis (Hourly chart)

Tenken-Sen- 117.85

Kijun-Sen- 118.06

CHF/JPY declined more than 100 pips from a temporary top around 118.86. The slight weakness in the Swiss franc is putting pressure on this pair at higher levels. USDCHF recovered slightly from the intraday low of 0.89572. Significant trend reversal only above 0.90450. The US 10- year bond yield is trading at a multi-year high in hopes of more stimulus is supporting the US dollar index. The intraday trend of CHFJPY remains bearish as long as resistance 118.85 holds.

Technical:

The pair's strong resistance is at 119, violation above will take to the next level 120/120.60. On the lower side, near-term support is around 117.69, and any indicative break below targets 117.30/116.91.

Indicator (60 min chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 118.25-30-50 with SL around 118.85 for the TP of 117.30.