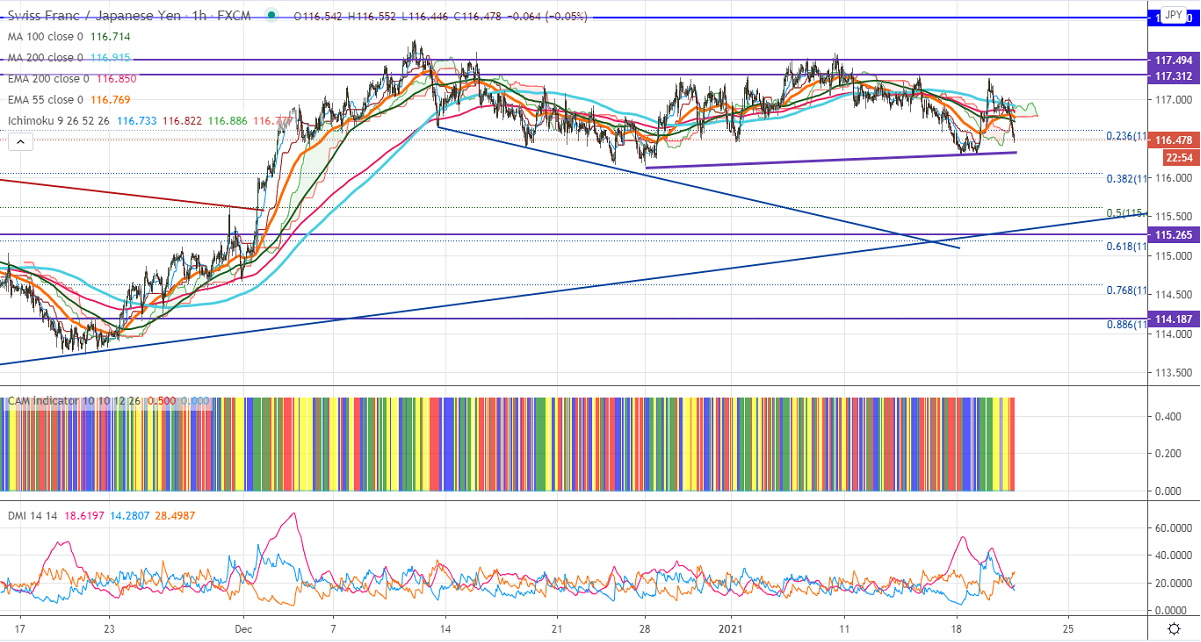

Ichimoku analysis (hourly chart)

Tenken-Sen- 116.65

Kijun-Sen- 116.75

CHF/JPY declining sharply after forming a minor top around 117.26. The strength in yen on increasing demand for Safe-haven assets. USDJPY is holding below 200-H MA, dip till 103.50 is possible. USDCHF is consolidating in a narrow range between 0.89253 and 0.88642 for the past three days. The intraday trend of CHFJPY remains bearish as long as resistance 117.26 holds.

Technical:

The pair's strong resistance is at 116.75, violation above will take to the next level 117/117.25/117.60/118.05/118.60. On the lower side, near term support is around 116.74, and any indicative break below targets 116.40/116/115.84.

Indicator (1-hour chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to sell on rallies around 116.55-60 with SL around 117 for the TP of 115.