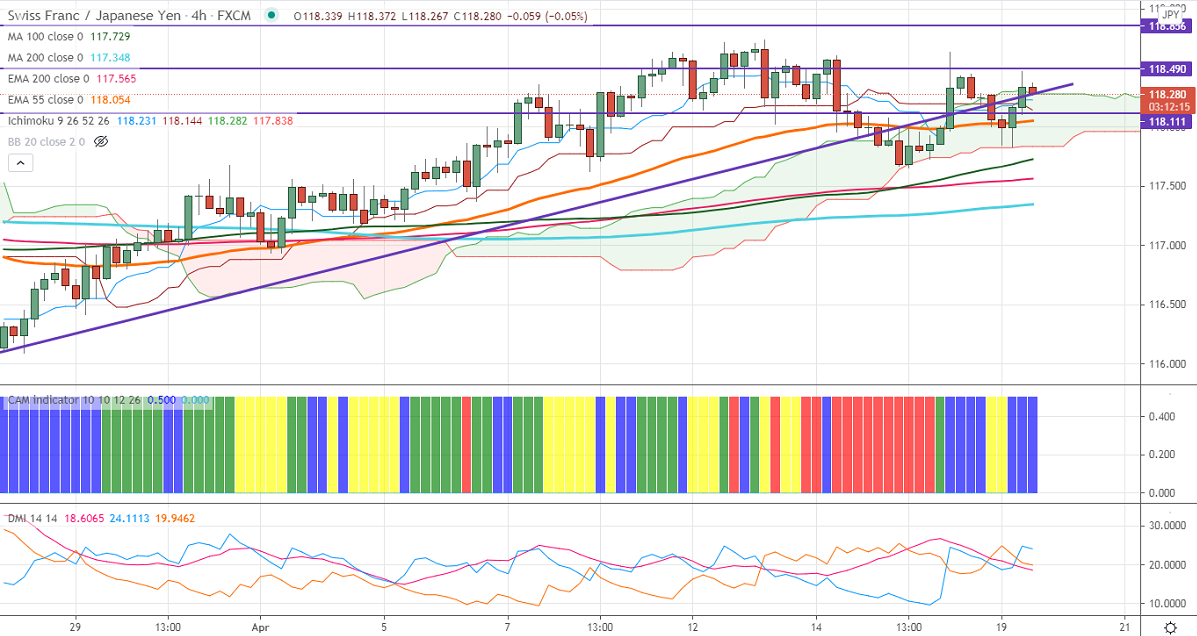

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 118.23

Kijun-Sen- 118.19

CHF/JPY recovered more than 50 pips after hitting a low of 117.83 on broad-based Swiss franc buying. USDCHF is trading weak for the past two weeks and lost nearly 350 pips. The strength in Yen due to selling in Bond yield is preventing the pair from further upside. USDJPY has taken support near 55-day EMA and shown a minor recovery. The intraday trend of CHFJPY is neutral as long as support 117.60.

Technical:

The pair's strong support is at 118, any break below confirms minor weakness, and a dip till 117.60/117.20/116.90/116.09 likely. On the higher side, near-term resistance is around 118.85 (Feb 17th high), and any indicative break above targets 119.60/120.40.

Ichimoku Analysis- The pair is trading above4- hour Kijun-Sen, Tenken-Sen, cloud, and 200-MA.

Indicator (4-Hour chart)

CAM indicator – Slightly Bullish

Directional movement index – Neutral

It is good to sell on rallies around 118.25-30 with SL around 118.85 for a TP of 117.