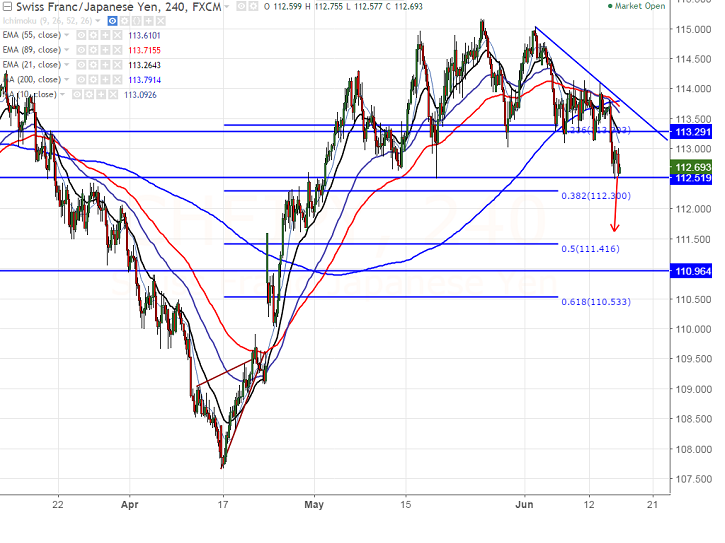

- CHF/JPY forms a minor top around 115.14 and started to decline from that level. The pair hits the low of 112.50 and is currently trading around 112.68.

- SNB kept its interest rates unchanged at minus 0.75% and has trimmed its inflation forecast.

- The major support is around 112.50 and any break below that level will drag the pair till 111.61/110.53 (61.8% retracement of 107.68 and 1151.14).

- On the higher side, in 4 hours chart near term resistance is around 113.10 (23.6% retracement of 115.03 and 112.50) and any indicative break above will take the pair till 113.78 (200 MA)/114.15 (Jun 9th low).

- Overall bearish invalidation only above 115.15.

It is good to sell on rallies around 113.10 with SL around 113.80 for the TP of 111.60/110.53.