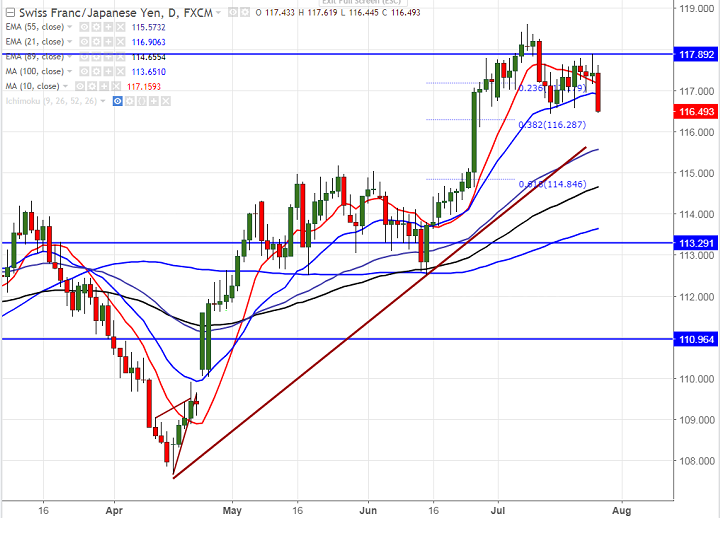

- The pair is consolidating in narrow range after hitting low of 116.43 on Jul 14th 2017. The pair formed minor top around 118.60 at Jul 10th 2017 and any further bullishness can be seen only above that level. It is currently trading around 116.45.

- Technically the pair is facing major support around 117.15 (daily Tenken-Sen) and any break below will drag the pair till 116.40/116.28 (38.2% fibo)/114.85.

- On the higher side, 117.60 will be acting as minor resistance and any break above will take the pair till 118/118.60. Any break above will take the pair till 119.25.

It is good to sell on rallies around 117.25-117.30 with SL around 118 for the TP of 116.40/114.85.

Resistance

R1- 118

R2 -118.60

R3- 119.25

Support

S1-116.40

S2-116.25

S3-114.85