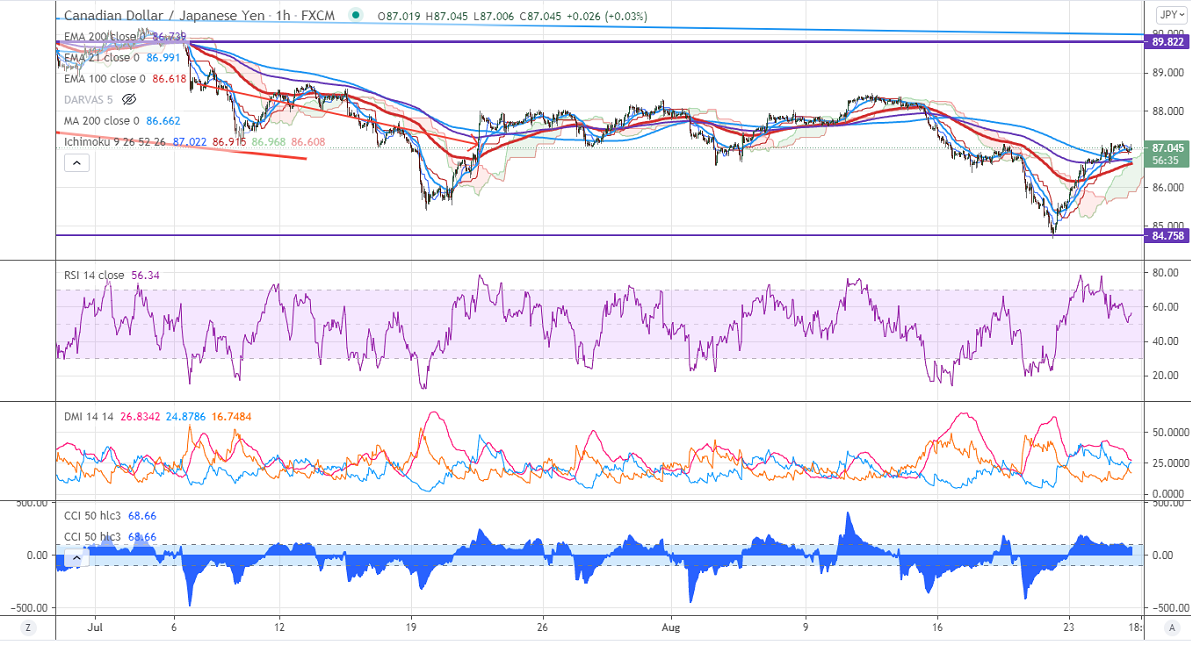

Ichimoku Analysis (1-hour chart)

Tenken-Sen- 87.04

Kijun-Sen- 86.91

Previous week High- 88.06

Previous Week low-86.57

CADJPY is trading higher for the past four trading sessions and jumped more than 250 pips. The jump was mainly due to the strong Canadian dollar. The intraday trend of CADJPY is bullish as long as support 87.65 holds.

USDCAD Analysis-

USDCAD was one of the worst performers this week and lost more than 200 pips on board-based US dollar selling. Any breach below 1.25950 confirms intraday bearishness.

USDJPY-

It is consolidating in a narrow range between 109.41 and 110.14 for the past two days. The intraday resistance to be watched 110.25. Significant support is around 109.

On the higher side, the pair is facing resistance at 87.50. Any indicative surge past targets 88/88.46.

The significant support is at 86.58, any decline below that level will drag the pair down to 85.97/85. BearishTrend continuation only below 84.65. A dip till 83 is possible.

It is good to buy on dips around 86.60 with SL around 86 for the TP 88.