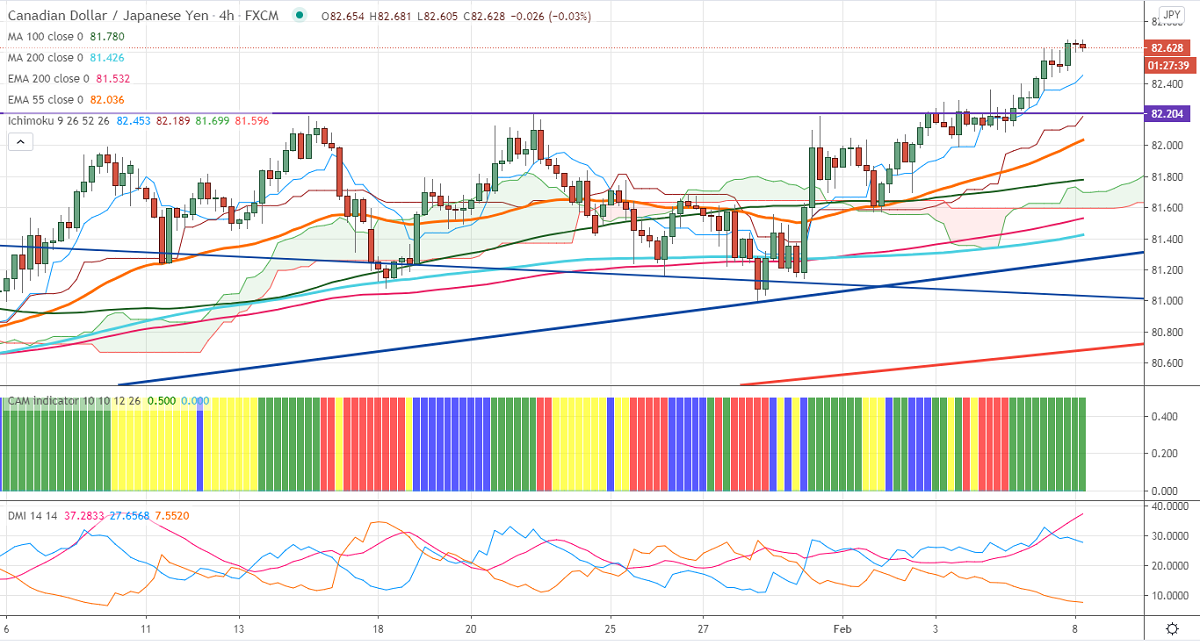

Ichimoku Analysis (4-hour chart)

Tenken-Sen- 82.40

Kijun-Sen- 82.128

CADJPY continues to trade higher for the third consecutive week. It has jumped more than 200 pips on board based on Yen's weakness. The upbeat global sentiment has decreased the demand for Safe-haven assets like yen, gold. USDCAD trades weak on surging crude oil price. WTI crude oil hits one year high on declining US and Chinese crude inventory. The Canadian economy has lost -212K jobs in Jan, the lowest level since Aug 2020. The short term trend of CADJPY is bullish as long as support 81.80 holds.

On the higher side, the pair is facing resistance at 82.85. Any indicative surge past targets 83.18/84/84.95.

The significant support is at 81.80, any decline below that level will drag the pair down till 81.40/81/80.55/80. Significant trend continuation only below 80. A dip till 79.60/79.23.

It is good to buy on dips around 82.25-30 with SL around 81.80 for the TP of 84/84.68.