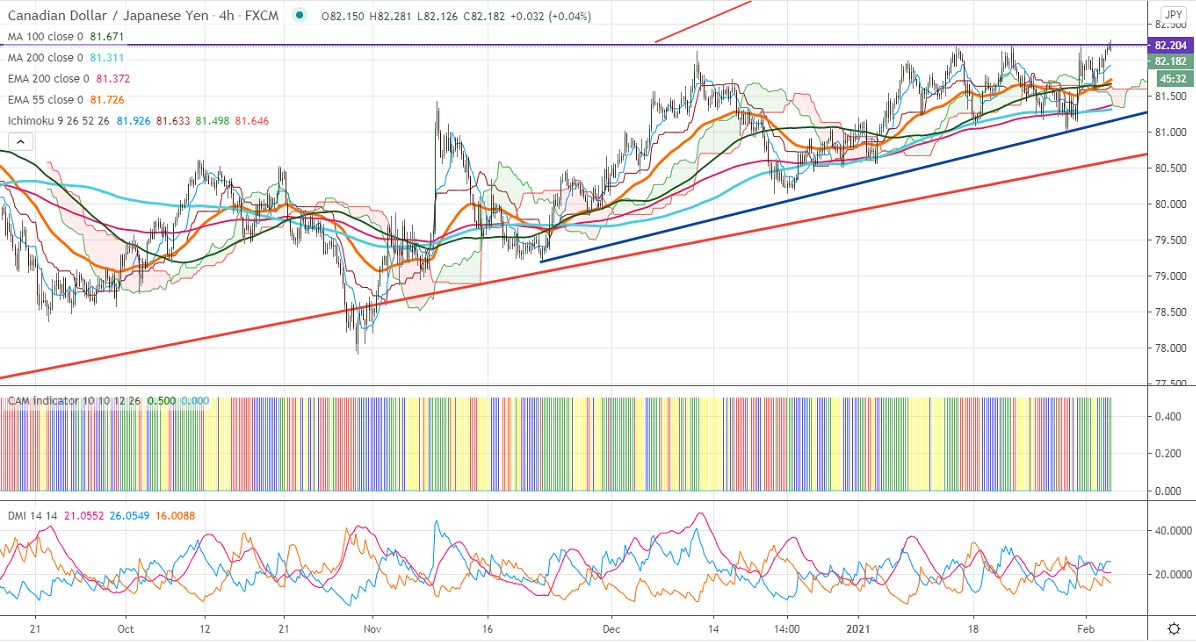

Ichimoku Analysis (4-hour chart)

Tenken-Sen- 81.92

Kijun-Sen- 81.63

CADJPY hits two weeks high at 82.28 and is hovering around that level. The Canadian dollar is the best performer against the USD despite broad based US dollar buying. The surge in crude oil prices and hopes of more stimulus is supporting the Canadian dollar. The decrease in demand for safe-haven assets like the yen is pushing the prices higher. USDCAD continues to trade weak for the second consecutive day, decline below 1.2760 confirms bullish continuation. The short term trend of CADJPY is bullish as long as support 81 holds.

On the higher side, the pair is trading above 82 levels. Any indicative surge past 82.30 targets 83/83.18.

The significant support is at 81, any decline below that level will drag the pair down till 80.55/80. Significant trend continuation only below 80. A dip till 79.60/79.23.

It is good to buy on dips around 82 with SL around 81 for the TP of 84/84.68.