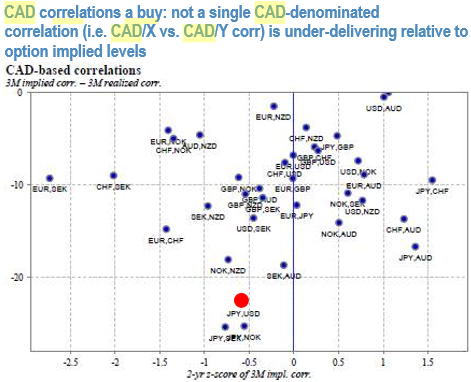

CAD-based implied correlations are priced well below realizeds for nearly the entire CAD-cross universe; owning CADUSD vs CADJPY corr. or a CADJPY - USDJPY vol spread is a positive carry NAFTA hedge. Notably, please be informed that the CAD implied vols are on lower side among G7 FX space.

As we have done with the Brexit-driven long GBP vol theme this year, NAFTA or BoC-related CAD-volatility is best isolated via easy-to-carry relative value structures. CAD-denominated correlations are a rich seam of trades to mine in this regard, as implied correlation in not a single CAD/X vs. CAD/Y pair is priced above trailing realizeds, and in most cases actually trades steeply under (refer above chart).

Among the relatively more liquid pairs, the most discounted CAD-corr of interest is CADUSD vs CADJPY (3M implied corr. 51, realized corrs 1-mo 75, 3-mo 73).

Given the low-yielding / funding currency status of both USD and JPY, and CAD’s traditionally tight link to the global growth cycle that tends to exert similar directional influence on both pairs, above-average correlation is the norm rather than the exception for CADUSD and CADJPY; chart 6 shows that a hypothetical strategy of systematically owning CADUSD vs CADJPY correlation swaps would have generated high Sharpe Ratio returns (excluding transaction costs, hence hypothetical) over a long history spanning multiple volatility cycles.

A transaction-cost friendly version of the full correlation triangle is to buy CADJPY – USDJPY vol spreads that are historically low (6M ATM spread 0.9 vs. 3-yr avg. 1.6), offers marginal (0.5 vol pts.) RV edge vs. the corr swap to go with greater liquidity, insulation to any idiosyncratic yen volatility stemming from an earlier/larger-than-expected re-set of the BoJ’s 10YY JGB yield target, and is similar in spirit to the GBPJPY – USDJPY vol spread we bought in the 2018 Outlook to hedge against any Brexit-related upheaval in the pound.

One concern is idiosyncratic USD volatility –especially a sharp rise in Treasury yields that sparks large scale USDJPY buying –that can potentially derail the short leg of the vol spread; our sense is that the steady-as-she-goes message from this week’s FOMC, thinner Republican Senate majority after the Alabama result that reduces odds of big bang fiscal (infrastructure) legislation, and seasonal softness of US data in 1Q renders that particular risk manageable through the first few months of next year. Courtesy: JPM

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis