We have not incorporated fiscal stimulus into our forecasts as we have not had the Budget yet but this should be an upside risk to our 2.2% growth forecast.

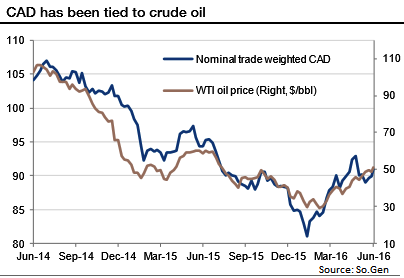

We look ahead for the BoC to begin tightening monetary policy H2 2016, contributing to a pullback that takes USD/CAD to 1.33 plus at year end. We stress that the lack of a recovery in crude oil (WTI) prices above $50-52 levels remains the most important risk to our CAD outlook from here onwards.

The Canadian dollar’s direction has been heavily influenced by crude oil prices in recent quarters (see graph).

So long as the recent lows in oil prices hold, there is room for CAD to outperform other commodity currencies in H2 16. It certainly offers better value and is less exposed to China than AUD or NZD.

Nonetheless, USD/CAD is unlikely to drop under 1.20 unless oil prices can rally durably beyond $60/bbl, which is not our baseline scenario.

The Canadian economy is being weighed down by weak investment, a high household debt burden, and the disruption to oil production caused by the Alberta wildfires. The new Federal government’s fiscal stimulus package should help growth, but it is a modest one.

The weak exchange rate should continue to drive exports growth, but that is vulnerable to any weakening of US demand. The Bank of Canada is thus likely to stay on hold throughout the year, as it looks to keep CAD weak.

A Fed rate hike in H2 16 and rising expectations ahead of it are expected to support USD/CAD from monetary divergence. An expected plateauing of the oil price trend going forward also eliminates what has been one of the key factors behind CAD strength in the first half of the year. But CAD offers good long-term value and investors should look to fade any sustained weakness in coming months.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate