Near-term CAD risks skewed positive but medium-term uncertainties linger. Although the past few weeks have brought little new to resolve medium-term uncertainties, recent relative outperformance is likely due to positive oil price exposure, and less stretched price and positioning compared to peers. Much of the swings in CAD this year (vs the USD as well as other peers) have been driven by oscillations of expectations around some major aspects of the Canadian macro backdrop.

Medium-term perspectives: The BoJ tightening may be a long way off, but that won’t stop markets from starting to price it in, supporting the yen and depressing CADJPY below 82.500 by Q3-end.

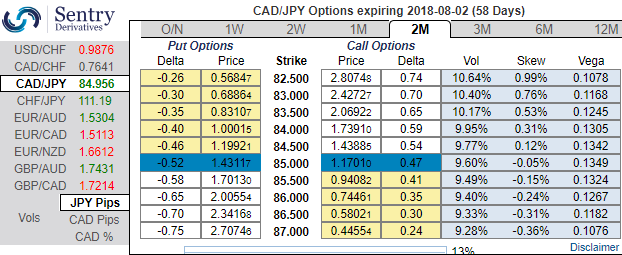

This is substantiated by the positively skewed IVs of 2m tenors, if you refer above nutshell, the skewness for the bids are for OTM puts upto 82.500 levels. Hence, hedgers’ sentiments are still mounting for the bearish risks.

We bought a 2m 87.100 CADJPY put, Reverse Knock-outs 83.100 for 14bp in mid-April while squaring off CADJPY positions, simultaneously, the short hedges were also suggested.

While simultaneously, Initiate shorts in futures contracts of mid-month tenors with a view to arresting further potential slumps.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -61 levels (bearish), while hourly JPY spot index was at -79 (bearish) while articulating (at 07:40 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary