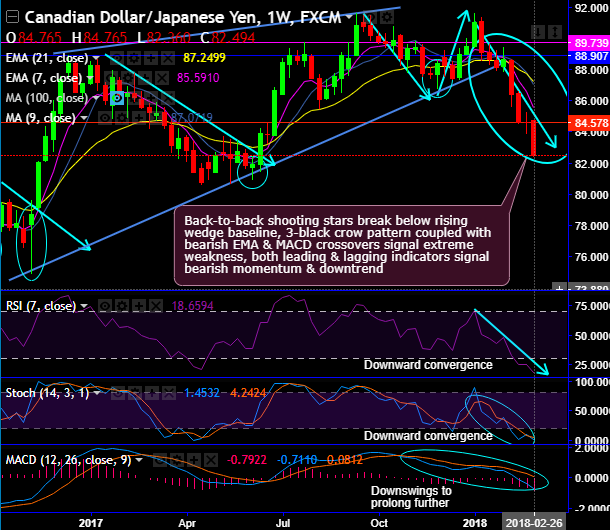

Chart and candlestick pattern formed- Shooting stars repeatedly at 88.634, 88.129 and 88.629 levels respectively (refer weekly plotting). These bearish patterns are followed by 3-black crow pattern which is again a serious bearish indication.

As a result, the bears have managed to breach below rising wedge baseline that has acted as the strong support so far in the intermediate trend (on weekly plotting).

On the broader perspective, shooting stars have occurred even on monthly terms at 87.251 and 88.649 levels. Thereafter, the steep slumps that have broken strong supports at 87.0501 (7SMA) and 84.5505 (i.e. 21SMA levels) in the recent past signal weakness (refer monthly plotting), the major bearish trend has now resumed after shooting stars formation on this timeframe, both leading & lagging indicators substantiate.

On this time frame, both RSI and stochastic curves have been converging downwards to selling interests.

To substantiate this bearish stance, the trend indicators (MACD, 7 & 21EMAs on weekly terms) have also been indicating bearish crossover that signal downtrend to prolong further.

Trade tips:

Contemplating both short and intermediate trend observations, it is wise to buy one touch put options with OTM strikes at 82 levels of mid-month tenors, with this leveraged product one can add magnified impact on the trade yields.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -69 levels (bearish), while hourly JPY spot index was at 28 (bullish) while articulating (at 07:27 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?