Technical roundup:

We could foresee weakness in CADJPY when we consider the intermediate and long term trend of this pair.

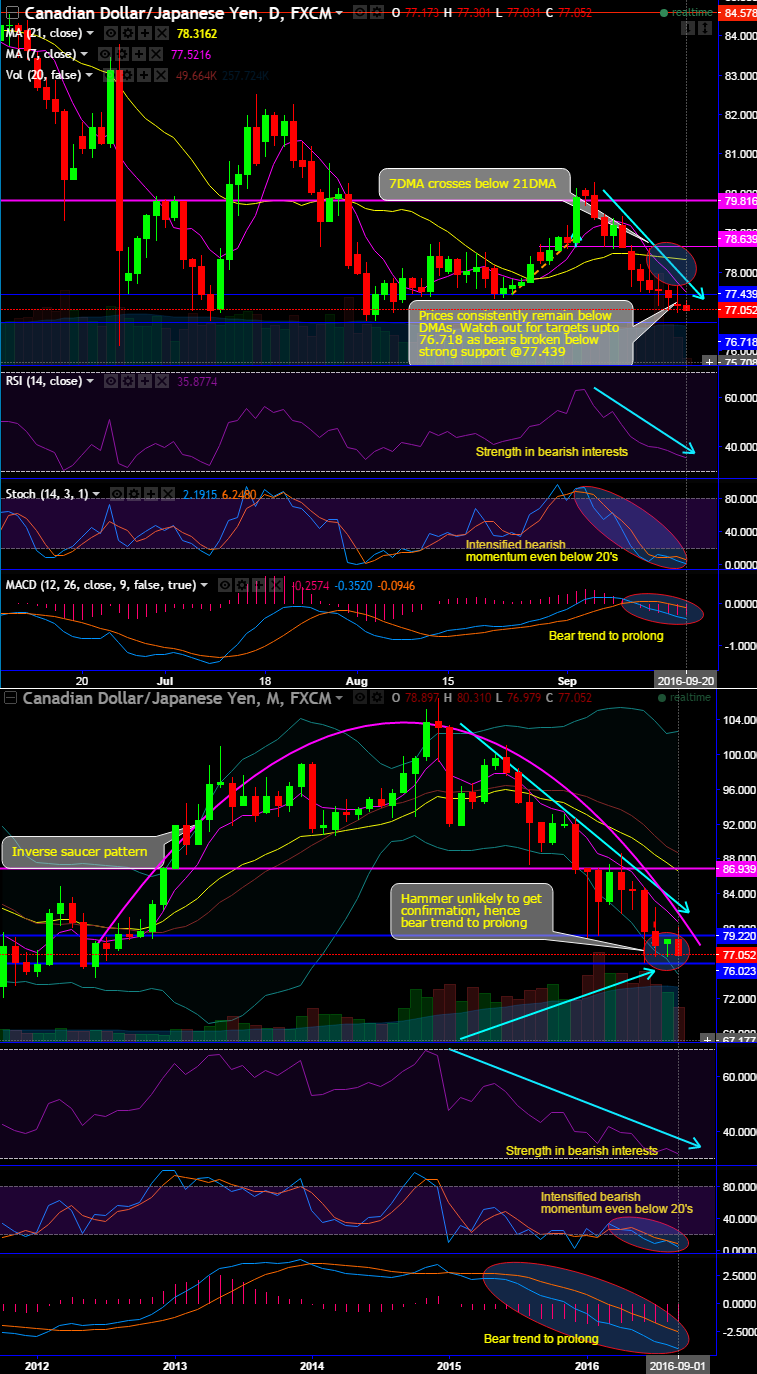

Prices consistently remain below DMAs, watch out for targets up to 76.718 as bears broken below strong support at 77.439 levels.

In addition to that, the leading indicators on both daily as well as monthly charts are converging to the current price declines that would suggest gaining momentum in selling pressures and likely to extend the ongoing trend.

Monthly RSI has convincingly been converging with price declines below 32 levels.

Slow stochastic has reached bearish territory but traces price recovery as we still observed %D crossover even below 20 levels on both daily and monthly terms that would mean selling pressure is still visible at this point of time.

Most notably, you can see 7DMA has just crossed below 21DMA; which is a sell signal.

To substantiate this stance, MACD has also shown a bearish crossover slipping below zero levels, hence, down trend is likely to persist.

On broader perspectives, price drops on monthly terms are confirmed with robust volumes.

Bearish appearances as the hammer pattern unlikely to get confirmation with a big bull candle and moreover, it has failed to even extend up to the immediate resistance at 79.220 levels (see red coloured circle areas), hence, we think the bear trend to prolong.

Trade tips: Contemplating intraday bearish sentiments, we recommend on pure speculation basis buying one touch binary puts in order to extract maximum leverage for extended profitability, for targets at 76.718 levels.

One can give the leveraging touch to your returns expectation if underlying pair keeps dipping by employing At-The-Money binary delta puts. But do remember these are exclusively for speculative basis.