The Bank of Canada and Bank of Japan are scheduled for their monetary policies this week, BoC arrives Wednesday along with the Monetary Policy Report that includes refreshed forecasts. Governor Poloz and SDG Wilkins will host a press conference.

The Canadian monetary policy announcement will be more about jawboning uncertainties within a base case policy framework that is in no rush to change. Having said this, the broad tone of the communications is likely to walk more on the cautiously optimistic side of the equation in such fashion as to remain faithful toward the Governor’s rebound narrative. If so, then at a minimum, the communications could be the further unwinding of near-term curve inversion.

Elsewhere, the Bank of Japan is expected to cut the growth outlook but keep policy unchanged this week. Judging from the rapid deterioration in exports and industrial production, GDP growth should have fallen sharply to close to 0% YoY in 1Q (negative QoQ is possible). This poses apparent risks to the BOJ’s FY19 forecast of 0.9%. Thankfully, core CPI remained stable in the range of 0.5-1.0% in 1Q. The expected inflation rate for the next one year also stood firmly, at 0.8% among enterprises and 3% among households. Steady inflation and inflation expectations should allow the BOJ to maintain the FY19 CPI forecast (0.9%) and argue that domestic recovery remains on track. The upside surprise from China’s March data, recovery in global risk appetite and dissipation of yen appreciation pressures should also provide some comfort for the BOJ.

CAD versus JPY is quietly consolidating at the midpoint of the recent range ahead of monetary policy announcements; the pair remain mid-term bullish. While crude oil has responded positively to developments, with WTI spiking above $65.50 levels, leaving the CAD’s broader out-performance on the day looking a little appealing.

OTC Updates and Options Trading Strategy (CADJPY):

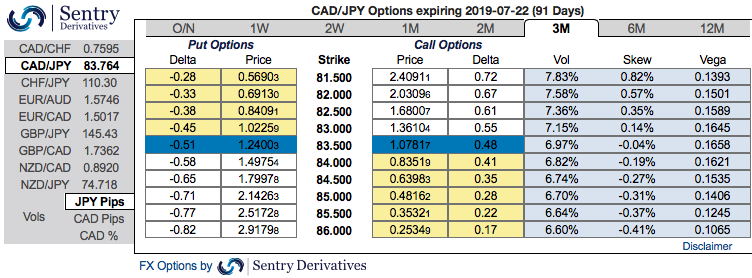

Positively skewed CADJPY IVs of 3m tenors have still been signaling bearish risks, the hedgers’ interests to bids for OTM put strikes up to 81.500 levels indicating downside risks in the medium terms. Please observe above technical chart for minor upswings in the short run that are to be capitalized for interim longs, while upholding short hedge as the major downtrend remains intact. Accordingly, we advocated options straps strategy to address both short-term upswings and major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of similar tenors. It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of a customized version of options combination and more bearish version of the common straddle.

Huge profits achievable with this strategy when the underlying currency exchange rate makes a strong move on either downwards or upwards at expiration, but greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to spike upwards in short run but major downtrend can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix, Scotia & DBS

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 40 levels (which is mildly bullish), hourly JPY spot index was at 120 (highly bullish) while articulating at (07:36 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty