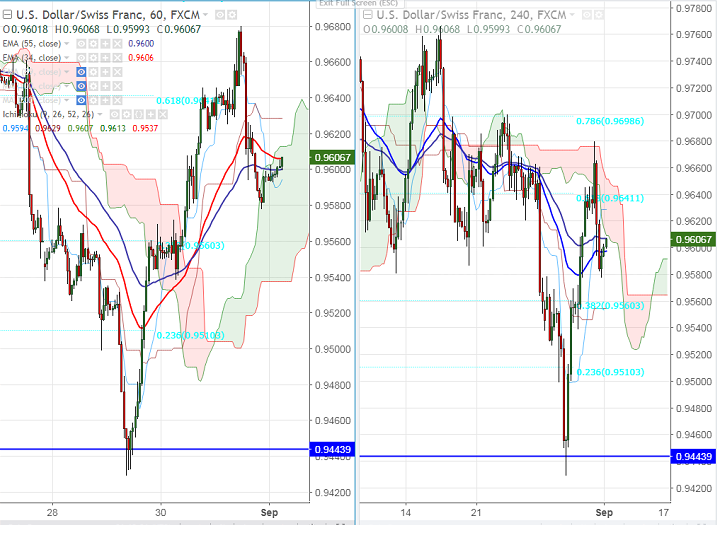

- USD/CHF has shown roller coaster ride yesterday. The pair hits intraday high of 0.96770 yesterday and declined sharply till 0.95823.

- Major near term intraday resistance is around 0.9630 and any break above confirms minor bullishness, a jump till 0.9680/0.9700/0.9725 likely. Short term bearish invalidation only above 0.97730.

- The near term support is around 0.9580 which formed triple bottom and any break below will drag the pair till 0.95295/0.9500. It should close below 0.94295 for further weakness.

- Market is expected to range bound and it awaits US NFP payroll for further direction. If data comes much better than expected that is above 209K it is extremely bullish for USD. If it comes at 180K in line with forecast – Moderately bullish. USD will be extremely weak if it comes below 150K.

It is good to buy above 0.9630 with SL around 0.9600 for the TP of 0.9680/0.9725.