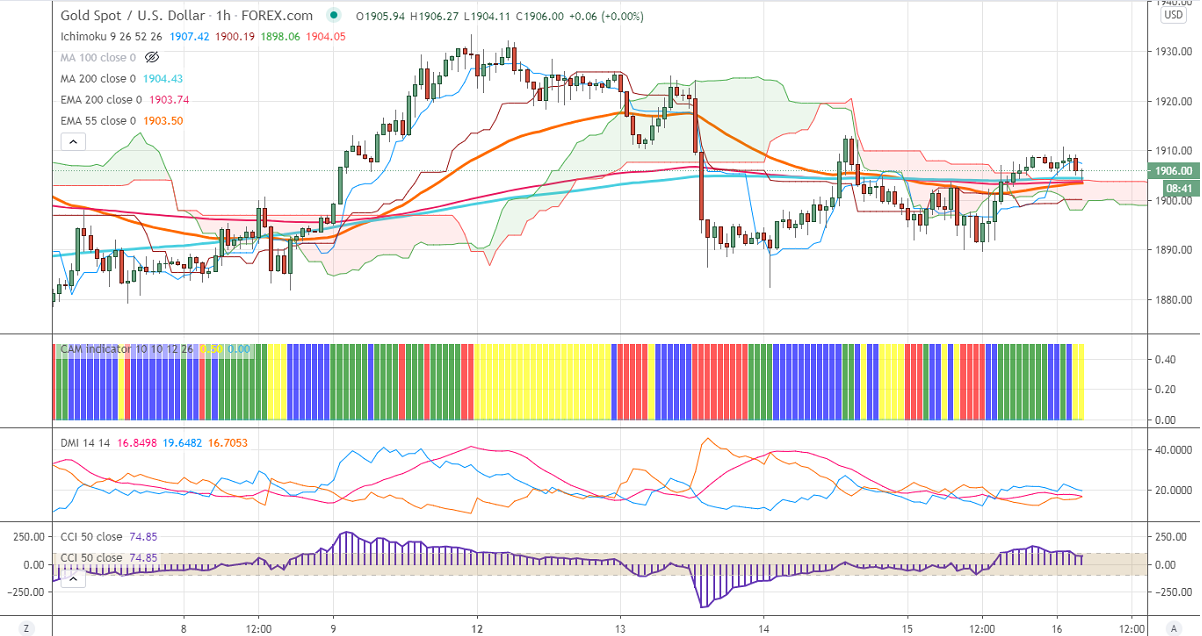

Ichimoku analysis (1- Hour chart)

Tenken-Sen- $1907

Kijun-Sen- $1900

Gold has once again recovered after showing a mild decline below $1900. The strength in the US dollar due to the diminishing chance of US stimulus is putting pressure on yellow metal at higher levels. DXY hits one week high and shown a minor dip. Any violation above 94 confirms bullish continuation.

Economic data:

The number of people who filed for unemployment benefits rose to 898000 vs forecast of 81000. The latest Philly Fed manufacturing index came at 32.3, rose from 17.3 last month.

Technical:

In the Hourly chart, Gold is trading slightly above the long-term moving average (200- MA) and Kijun-Sen. Any break above $1910 will take the pair till $1920/$1933. On the flip side, near term intraday support is around $1880 and any indicative break below that level will take the pair till $1860/$1848.

It is good to buy on dips around $1895-96 with SL around $1880 for the TP of $1920/$1933.