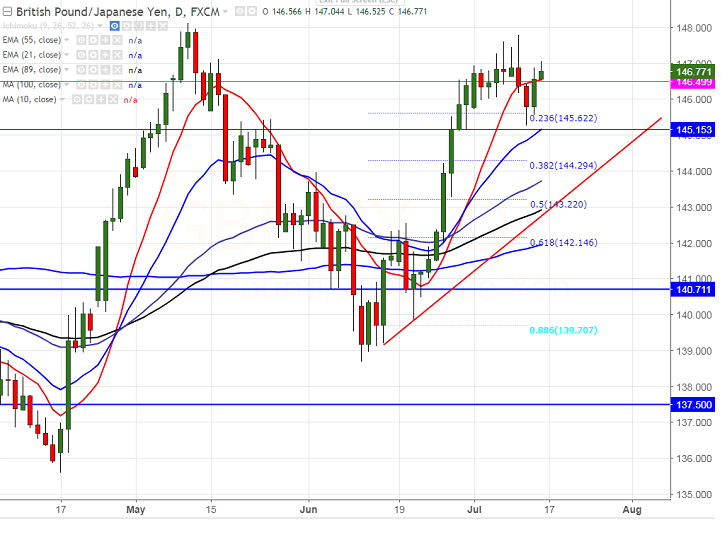

- GBP/JPY has declined sharply after forming a temporary top around 147.77. The pair hits low of 145.26 and slightly recovered from that level. It is currently trading around 146.75.

- Short term trend is bullish as long as support 144.85 (21- day EMA) holds. Any minor weakness can be seen only below that level.

- The pair formed major top around 148.45 on Dec 15th 2016 and any bullish continuation can be seen only above that level. Any violation above will take the pair till 150/156. It has closed slightly above Tenken-Sen and Kijun-Sen in the daily chart yesterday.

- Overall bullish invalidation only below 135.45 (Apr 17th 2017).

- Momentum indicator RSI and lagging indicator MACD both showing buy signal in the daily chart.

It is good to buy on dips around 146.25-30 with 145 for the TP of 148.45/150.