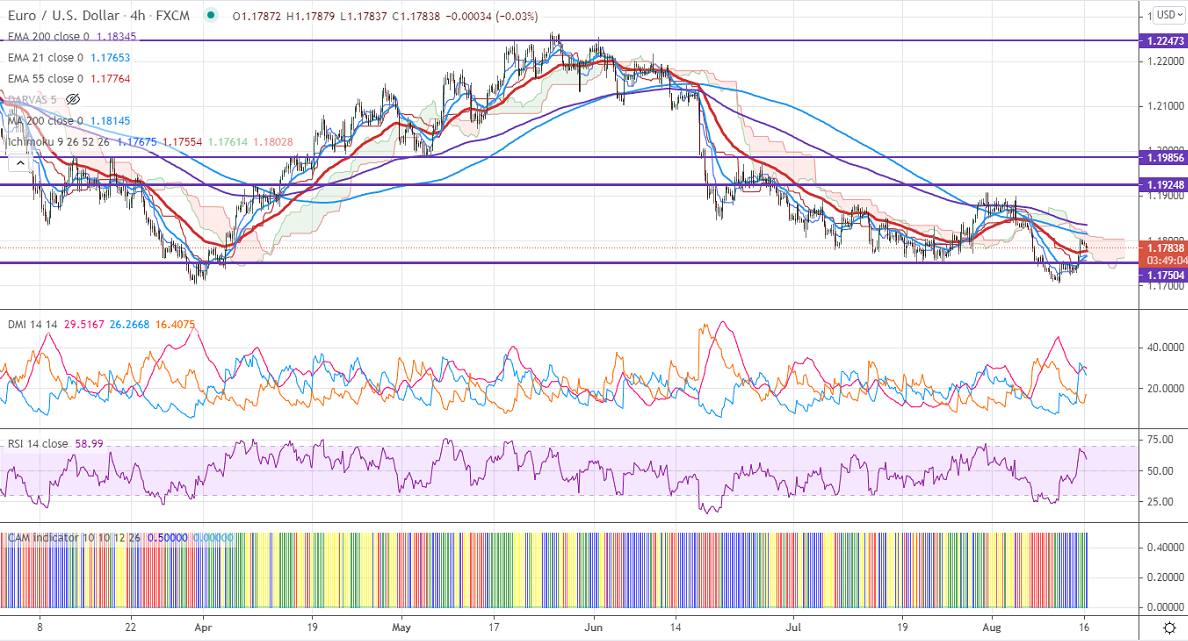

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.17666

Kijun-Sen- 1.17554

EURUSD recovered more than 40 pips after dismal US consumer confidence. The University of Michigan consumer sentiment declined sharply to 70.20 for Aug, the lowest level since 2011. The US 10-year yield lost more than 5% after the data. But weak Chinese data and the spread of the delta variant of the corona are putting pressure on Euro at higher levels. The pair hits an intraday low of 1.17863 and is currently trading around 1.17858.

Technical:

On the higher side, near-term resistance is around 1.1835 and any convincing breach above will take to the next level 1.1900/1.1920/1.1965. The pair's near-term support is at 1.1760, break below targets 1.1700/1.1660.

Indicator (4-hour chart)

CAM indicator-Slightly Bullish

Directional movement index – Neutral

It is good to buy on dips around 1.1748-50 with SL around 1.1700 for the TP of 1.1900.