Gold should see investor appetites improve, after the Fed signalled low interest rates and ongoing asset purchases, while the dollar steadies on risk-off mode, however undertone still softer.

The gold price has been edging above $1,730 levels, the resurgence of precious yellow metal is considerable from the last three days of trading sessions, especially after the test of strong support zone of $1,669.869 levels.

Gold futures rallied but exhausted currently after one-two lift as the Federal Reserve vowed to hold interest rates lower for longer and sustain vast stimulus to support a recovery from the pandemic Covid-19, and the investors tracked traces of a resurgence in infections in some U.S. states. The gold price had been under pressure before the meeting, as investor expectations of the Fed turning to yield curve control receded, dampening appetite.

However, the open-ended asset purchasing program gave comfort to those who have been worried that rising asset prices could curtail Fed buying. Silver prices rallied even stronger, as investors looked to the unloved precious metal.

OTC Updates:

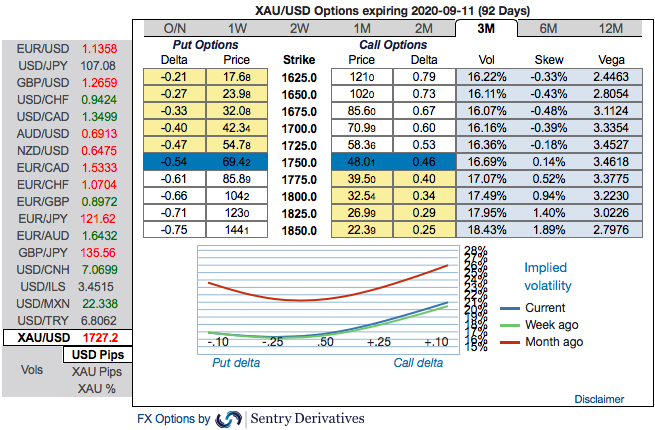

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,850 is quite evident that reminds us hedgers’ inclination for the upside risks.

One could also see the fresh negative bids for the existing bullish risk reversal setup. To substantiate the above-mentioned bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2nd nutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future but they can also be utilized for trading purpose depending on the underlying trend/swings.

Options Strategies:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, one can also stay long positions CME gold contracts of June’2020 deliveries as we could foresee more upside risks. Courtesy: Sentry, ANZ & Saxobank

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data