INR can outperform in an environment of higher global rates but USDINR should find decent support from current levels towards the low 66.00 region in terms of spot.

Bearish INR risk scenarios:

1) Demonetization drives a sharper correction in the economy than expected,

2) Oil prices spike to $60/bbl,

3) Global equity market sentiment weaken.

Bullish INR risk scenarios:

1) Reform agenda gains further momentum,

2) FII limits are increased,

3) New RBI Governor reduces intervention bias.

Risk-efficient short gamma trading through 3M-1Y calendar spreads While USDINR had recouped all the lost incurred since the Q4 demonetization phase, the drop in spot over the past two days cleared the 66.0 level in a decisive way not witnessed since 2015, and caused an uptick in front-end vols (see above chart).

With dealer activity unlikely to account for large price movements in our opinion, ex-post explanations for the move always involve considerations of looser RBI reserve accumulation, Modi’s blockbuster legislative election win and prospects for further structural reforms, support from the drop in Oil prices and real money flows.

A neutral view on the currency is held, and chasing moves lower in USDINR doesn’t present great risk/reward perspectives. The dynamic of portfolio inflows into the fastest growing major economy, contained by RBI intervention, is likely to remain in effect, especially since India has been left out of the trade tension narrative pushed by President Trump.

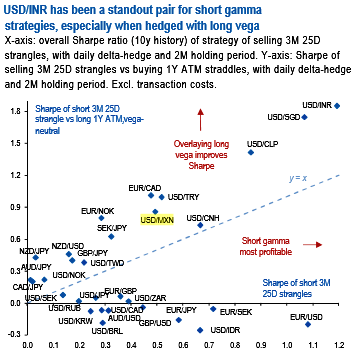

Note that RBI actions lead to India ranking third in terms of size of FX intervention behind Switzerland and Taiwan, but the pace of intervention is far below the 2% GDP threshold that raises eyebrows in the Trump camp. Over the past few years, USDINR has been the pair where short gamma strategies have delivered their highest Sharpe ratios, along with EURUSD and USDSGD (see above chart).

Unlike in EURUSD however, overlaying a long vega leg, resulting in vega-neutral positions, has improved risk/rewards significantly and led to an appreciable alpha generation strategy.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis